Nasdaq 100 Technology Index(NDXT)INDEX/NASDAQ

Grocery Outlet's (NASDAQ:GO) Q1 Sales Beat Estimates But Stock Drops 19.2%

Discount grocery store chain Grocery Outlet (NASDAQ:GO) reported Q1 CY2024 results topping analysts' expectations, with revenue up 7.4% year on year to $1.04 billion. The company expects the full year's revenue to be around $4.33 billion, in line with analysts' estimates. It made a non-GAAP profit of $0.09 per share, down from its profit of $0.27 per share in the same quarter last year.

Is now the time to buy Grocery Outlet? Find out by accessing our full research report, it's free.

Grocery Outlet (GO) Q1 CY2024 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $1.02 billion (1.4% beat)

- Adjusted EBITDA: $39.4 million vs analyst estimates of $52.3 million (big miss)

- EPS (non-GAAP): $0.09 vs analyst estimates of $0.18 (-$0.09 miss)

- The company reconfirmed its revenue guidance for the full year of $4.33 billion at the midpoint

- The company lowered its gross margin and adjusted EBITDA guidance for the full year

- Gross Margin (GAAP): 29.3%, down from 31.1% in the same quarter last year

- Free Cash Flow was -$38.43 million, down from $54.74 million in the same quarter last year

- Same-Store Sales were up 3.9% year on year

- Store Locations: 474 at quarter end, increasing by 30 over the last 12 months

- Market Capitalization: $2.58 billion

"Our sales momentum remained strong during the first quarter as we continue to deliver unbeatable value with an exciting treasure hunt experience, driving continued growth in traffic and sales," said RJ Sheedy, President and CEO of Grocery Outlet.

Due to its differentiated procurement and buying approach, Grocery Outlet (NASDAQ:GO) is a discount grocery store chain that offers substantial discounts on name-brand products.

Grocery Store

Grocery stores are non-discretionary because they sell food, an essential staple for life (maybe not that ice cream?). Selling food, however, is a notoriously tough business as grocers must deal with the costs of procuring and transporting oftentimes perishable products. Plus, the costs of operating stores to sell everything from raw meat to ice cream and fresh fruit are high. Competition is also fierce because grocers and other peers such as wholesale clubs tend to sell very similar brands and products. On the bright side, grocery is one of the least penetrated categories in e-commerce because customers prefer to buy their food in person. Still, the online threat exists and will likely increase over time rather than dwindle.

Sales Growth

Grocery Outlet is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

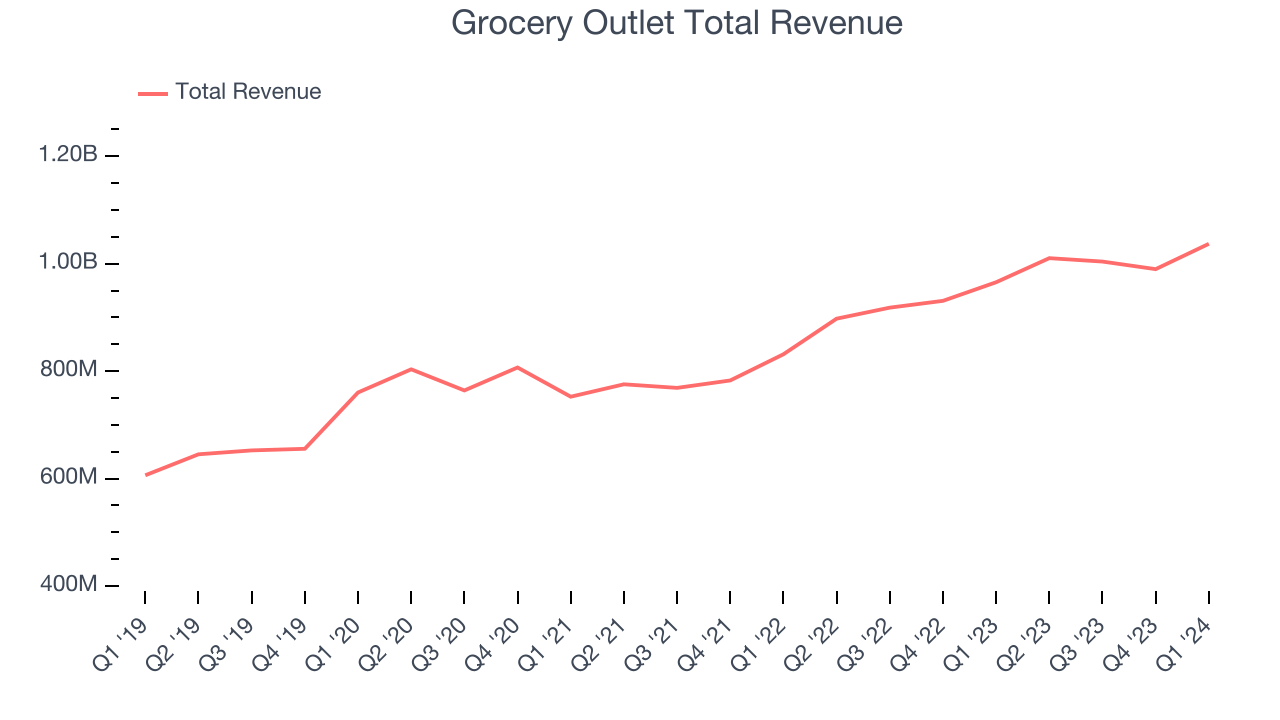

As you can see below, the company's annualized revenue growth rate of 11.5% over the last five years was decent as it opened new stores and grew sales at existing, established stores.

This quarter, Grocery Outlet reported solid year-on-year revenue growth of 7.4%, and its $1.04 billion in revenue outperformed Wall Street's estimates by 1.4%. Looking ahead, Wall Street expects sales to grow 10.2% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

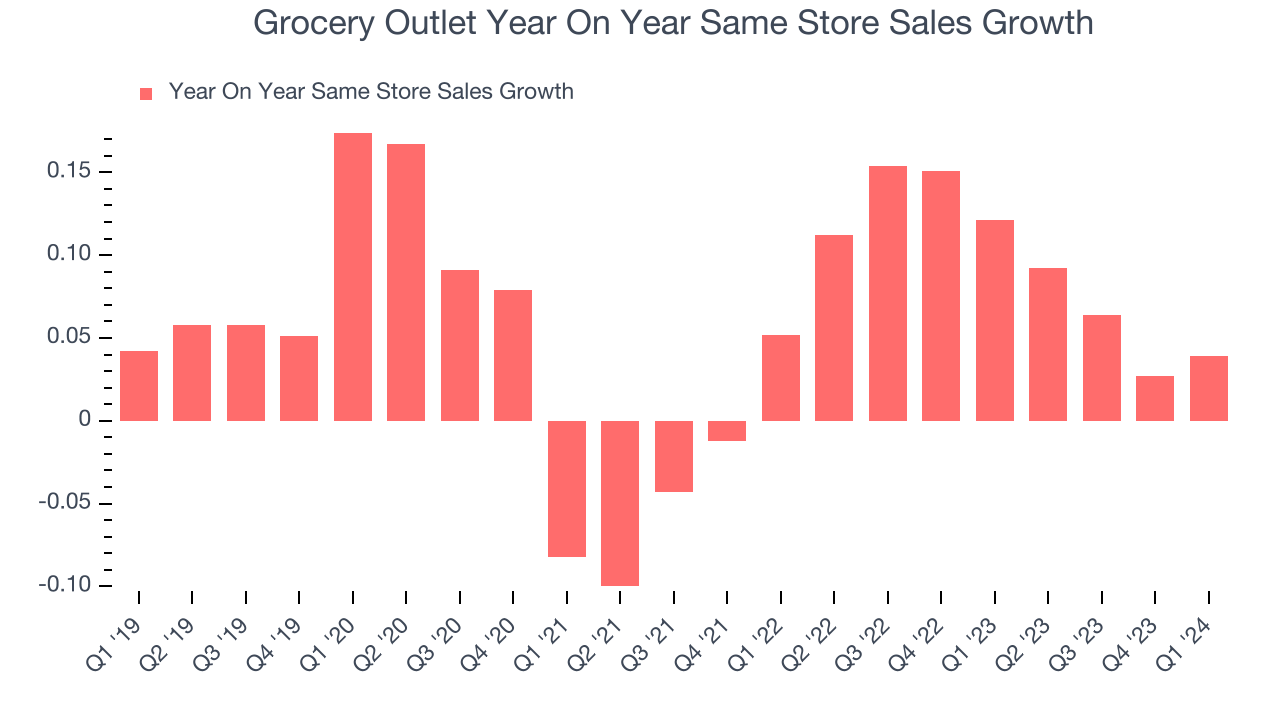

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Grocery Outlet's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 9.5% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Grocery Outlet is reaching more customers and growing sales.

In the latest quarter, Grocery Outlet's same-store sales rose 3.9% year on year. By the company's standards, this growth was a meaningful deceleration from the 12.1% year-on-year increase it posted 12 months ago. We'll be watching Grocery Outlet closely to see if it can reaccelerate growth.

Key Takeaways from Grocery Outlet's Q1 Results

It was good to see Grocery Outlet beat analysts' revenue expectations this quarter. On the other hand, adjusted EBITDA missed by a meaningful amount, and the company's full-year earnings forecast missed analysts' expectations. Overall, this was a mediocre quarter for Grocery Outlet. The company is down 19.2% on the results and currently trades at $20.96 per share.

Grocery Outlet may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.