TSX Renewable and Clean Tech Index(TXCT)INDEX/TSX

Upstart (NASDAQ:UPST) Surprises With Q1 Sales But Quarterly Guidance Underwhelms

AI lending platform Upstart (NASDAQ:UPST) beat analysts' expectations in Q1 CY2024, with revenue up 24.2% year on year to $127.8 million. On the other hand, next quarter's revenue guidance of $125 million was less impressive, coming in 12.8% below analysts' estimates. It made a non-GAAP loss of $0.31 per share, improving from its loss of $1.58 per share in the same quarter last year.

Is now the time to buy Upstart? Find out by accessing our full research report, it's free.

Upstart (UPST) Q1 CY2024 Highlights:

- Revenue: $127.8 million vs analyst estimates of $124.8 million (2.4% beat)

- EPS (non-GAAP): -$0.31 vs analyst estimates of -$0.39

- Revenue Guidance for Q2 CY2024 is $125 million at the midpoint, below analyst estimates of $143.3 million

- Gross Margin (GAAP): 50.6%, down from 60.6% in the same quarter last year

- Free Cash Flow of $50.87 million is up from -$71.44 million in the previous quarter

- Market Capitalization: $2.26 billion

Founded by the former head of Google's enterprise business Dave Girouard, Upstart (NASDAQ:UPST) is an AI-powered lending platform that helps banks better evaluate the risk of lending money to a person and provide loans to more customers.

Lending Software

Businesses have come to use data driven insights to stratify their customers into more granular buckets that enable more personalized (and profitable) offerings. Lending software is a prime example of fintech democratizing access to loans in a still-profitable manner for financial institutions.

Sales Growth

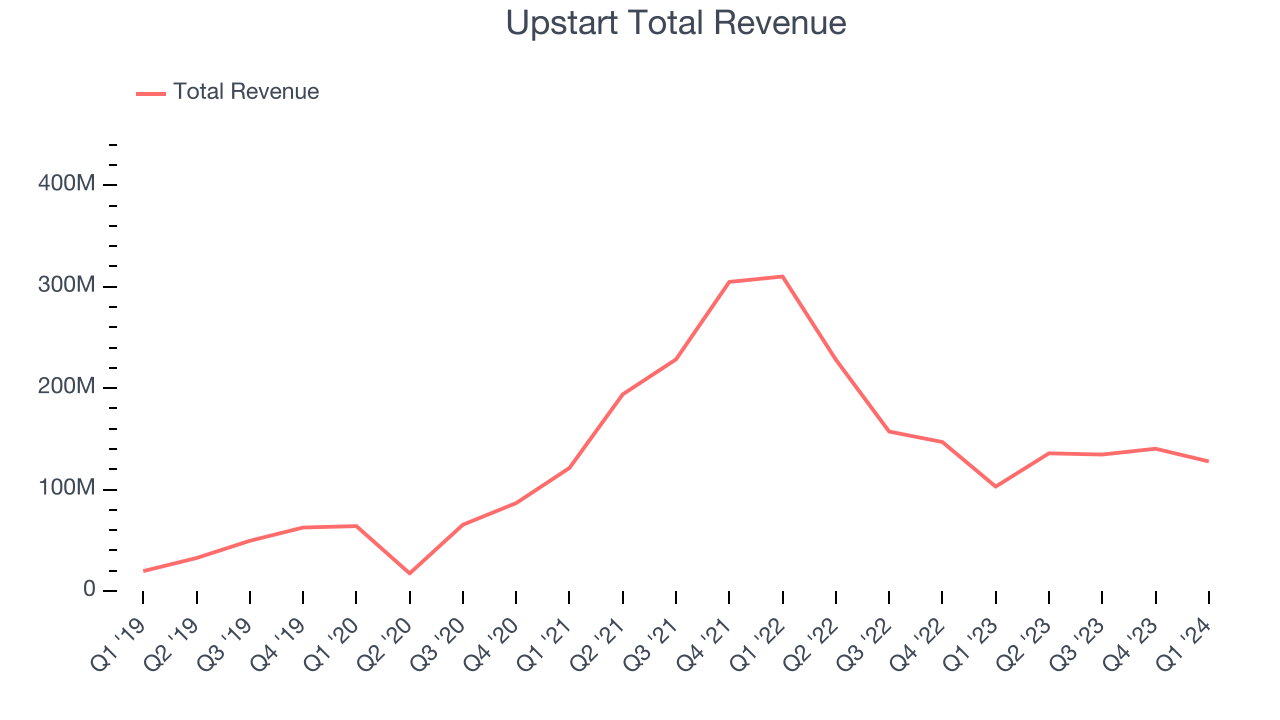

As you can see below, Upstart's revenue growth has been volatile over the last three years, growing from $121.3 million in Q1 2021 to $127.8 million this quarter.

This quarter, Upstart's quarterly revenue was once again up a very solid 24.2% year on year. However, the company's revenue actually decreased by $12.52 million in Q1 compared to the $5.76 million increase in Q4 CY2023. Taking a closer look we can a similar revenue decline in the same quarter last year, which could suggest that the business has seasonal elements. Regardless, this situation is worth monitoring as management is guiding for a further revenue drop in the next quarter.

Next quarter, Upstart is guiding for a 7.9% year-on-year revenue decline to $125 million, an improvement on the 40.5% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 17.7% over the next 12 months before the earnings results announcement.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Upstart's free cash flow came in at $50.87 million in Q1, turning positive over the last year.

Upstart has generated $26.17 million in free cash flow over the last 12 months, or 4.9% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Upstart's Q1 Results

It was good to see Upstart beat analysts' revenue expectations this quarter and produce free cash flow. On the other hand, its revenue guidance for next quarter missed analysts' expectations and its gross margin shrunk. Overall, the results could have been better. The stock is flat after reporting and currently trades at $24.5 per share.

So should you invest in Upstart right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.