TSX Composite Index(TXCX)INDEX/TSX

ON24's (NYSE:ONTF) Q1 Sales Top Estimates

Virtual events software company (NYSE:ONTF) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue down 12.4% year on year to $37.73 million. The company expects next quarter's revenue to be around $36.3 million, in line with analysts' estimates. It made a non-GAAP profit of $0.02 per share, improving from its loss of $0.04 per share in the same quarter last year.

Is now the time to buy ON24? Find out by accessing our full research report, it's free.

ON24 (ONTF) Q1 CY2024 Highlights:

- Revenue: $37.73 million vs analyst estimates of $37 million (2% beat)

- EPS (non-GAAP): $0.02 vs analyst estimates of -$0.01 ($0.03 beat)

- Revenue Guidance for Q2 CY2024 is $36.3 million at the midpoint, roughly in line with what analysts were expecting

- The company reconfirmed its revenue guidance for the full year of $145 million at the midpoint

- Gross Margin (GAAP): 74.1%, up from 71.3% in the same quarter last year

- Free Cash Flow of $1.1 million is up from -$1.97 million in the previous quarter

- Market Capitalization: $286.5 million

“In Q1, we continued to execute against our strategic and financial targets, delivering solid topline results and achieving our profitability targets for the fourth quarter in a row,” said Sharat Sharan, co-founder and CEO of ON24.

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

Virtual Events Software

Online marketing and sales are expanding at a rapid pace. Compared to the offline advertising market, which has been affected by the Covid pandemic and is challenging to measure and improve, more organizations are expected to adopt data-driven digital engagement platforms to better engage their customers online.

Sales Growth

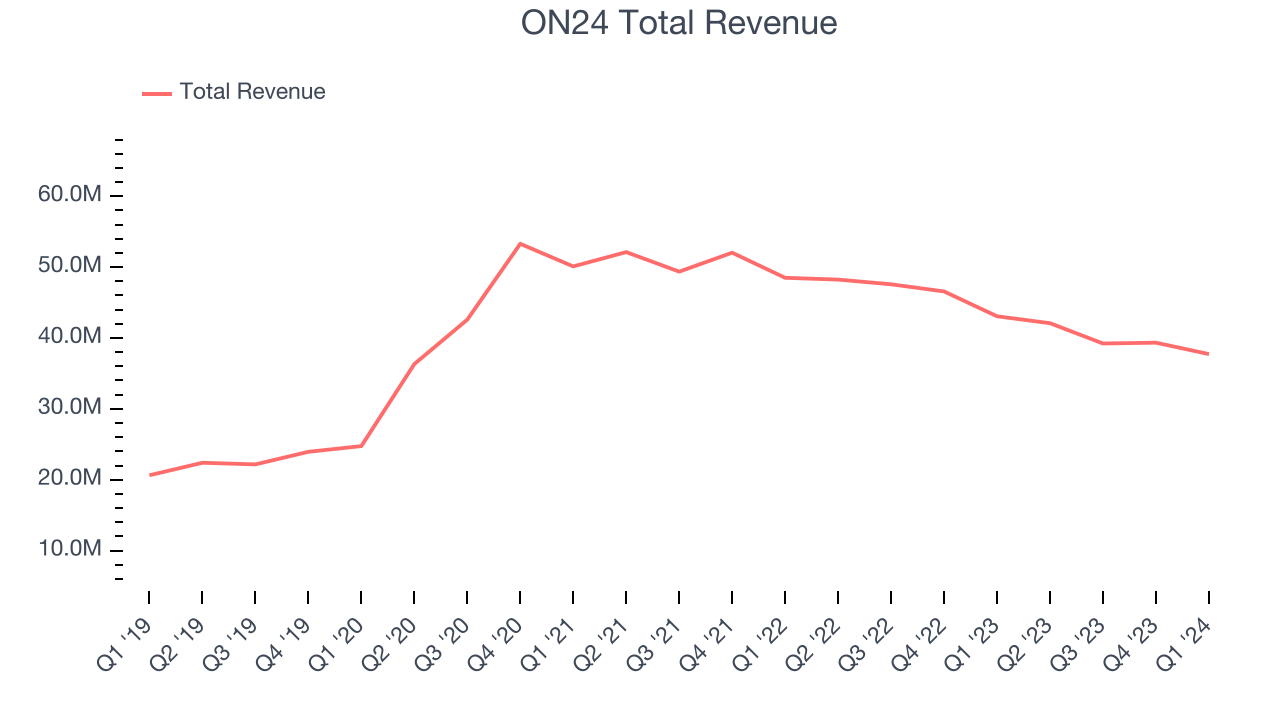

As you can see below, ON24's revenue has declined over the last three years, shrinking from $50.1 million in Q1 2021 to $37.73 million this quarter.

ON24's revenue was down again this quarter, falling 12.4% year on year.

Next quarter, ON24 is guiding for a 13.7% year-on-year revenue decline to $36.3 million, a further deceleration from the 12.8% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street was expecting revenue to decline 9.3% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. ON24's free cash flow came in at $1.1 million in Q1, turning positive over the last year.

ON24 has burned through $8.94 million of cash over the last 12 months, resulting in a negative 5.6% free cash flow margin. This low FCF margin stems from ON24's constant need to reinvest in its business to stay competitive.

Key Takeaways from ON24's Q1 Results

We enjoyed seeing ON24 exceed analysts' billings expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street's estimates. Overall, this quarter's results seemed fairly positive. The stock is flat after reporting and currently trades at $6.76 per share.

So should you invest in ON24 right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.