Database software company MongoDB (MDB) announced better-than-expected results in Q4 FY2024, with revenue up 26.8% year on year to $458 million. On the other hand, next quarter's revenue guidance of $438 million was less impressive, coming in 2.5% below analysts' estimates. It made a non-GAAP profit of $0.86 per share, improving from its profit of $0.57 per share in the same quarter last year.

Is now the time to buy MongoDB? Find out by accessing our full research report, it's free.

"MongoDB finished fiscal 2024 on a strong note, highlighted by 34% Atlas revenue growth and operating margin improvement of nearly five percentage points year-over-year. We continue to see healthy new workload wins as MongoDB's developer data platform increasingly becomes the standard for modern application development," said Dev Ittycheria, President and Chief Executive Officer of MongoDB.

Started in 2007 by the team behind Google’s ad platform, DoubleClick, MongoDB offers database-as-a-service that helps companies store large volumes of semi-structured data.

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

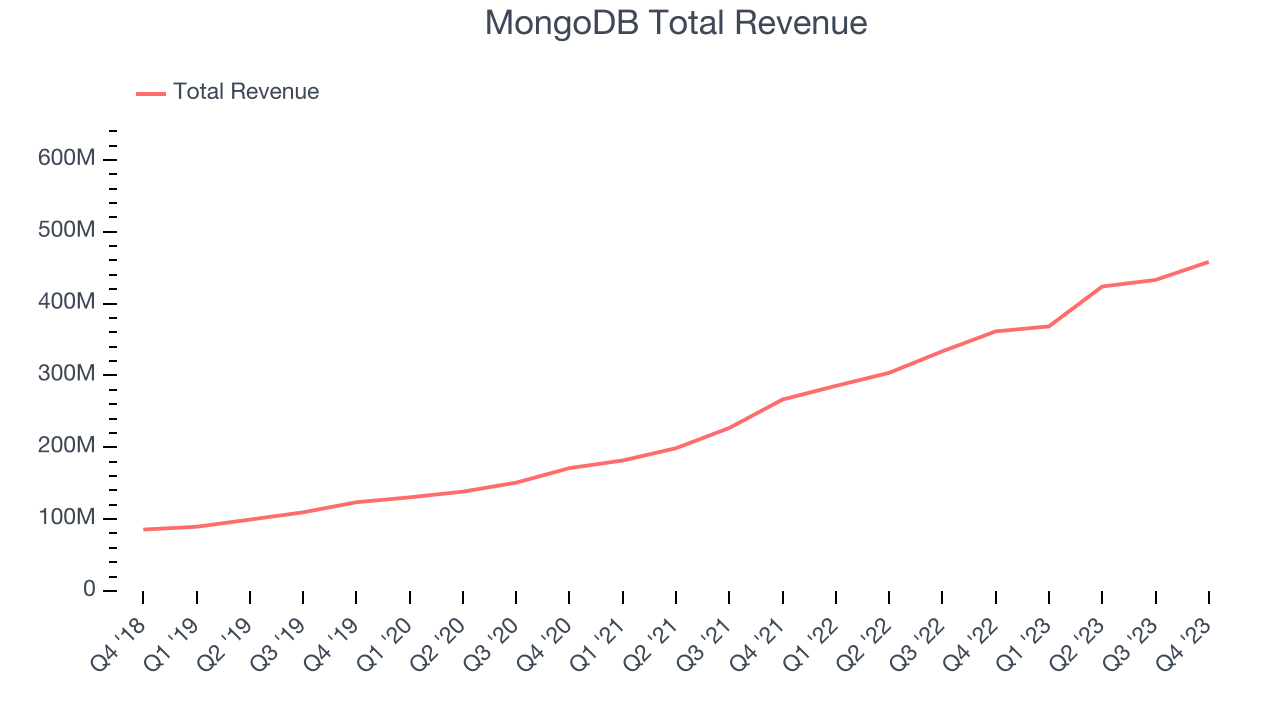

As you can see below, MongoDB's revenue growth has been very strong over the last two years, growing from $266.5 million in Q4 FY2022 to $458 million this quarter.

This quarter, MongoDB's quarterly revenue was once again up a very solid 26.8% year on year. On top of that, its revenue increased $25.06 million quarter on quarter, a very strong improvement from the $9.15 million increase in Q3 2024. This is a sign of acceleration of growth and great to see.

Next quarter's guidance suggests that MongoDB is expecting revenue to grow 18.9% year on year to $438 million, slowing down from the 29% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.92 billion at the midpoint, growing 13.8% year on year compared to the 31.1% increase in FY2024.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

MongoDB reported 47,800 customers at the end of the quarter, an increase of 1,400 from the previous quarter. That's in line with the customer growth we observed last quarter but a bit below what we've typically seen over the last year, suggesting that sales momentum may be slowing a little.

We enjoyed seeing MongoDB exceed analysts' revenue expectations and deliver strong free cash flow this quarter. On the other hand, its full-year revenue guidance was below expectations and suggests a slowdown in demand. Overall, this was a mixed quarter for MongoDB. The company is down 7.1% on the results and currently trades at $382.94 per share.

MongoDB may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

All market data (will open in new tab) is provided by Barchart Solutions. Copyright © 2024.

Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms of use, please read disclaimer (will open in new tab).