S&P Smallcap Consumer Discretionary Invesco ETF(PSCD-Q)NASDAQ

Benefiting from active management in Fixed Income

Proponents of passive approaches for equity investors often argue that the index itself reflects an efficient measurement of the market’s valuation of the stocks in the index. In contrast, indices for fixed income have some important differences from their equity counterparts, which make them less efficient as reflections of the overall market’s views. For example, although bond indices are weighted by the market cap of the underlying securities, the pricing of individual bonds is “over the counter”, making price movements less driven by the transactions of a wide population of investors trading on a public exchange.

This article will highlight the case for why an active management approach to fixed income can prove to be beneficial for investors and ETF solutions that employ such an approach.

The case for active management in fixed-income

Passive management strategies have grown in popularity in recent years due to lower costs and the perception of market efficiency. But in the realm of fixed income, the argument for taking an active approach is compelling for several reasons, namely, market structure, credit deterioration, and dispersion—where index-tracking approaches may fall short.

Market structure

Fixed-income markets are substantially larger than equity markets and tend to be fragmented, opaque, and prone to experiencing volatile liquidity events; making it an arena where skilled and knowledgeable managers can navigate uncertainty. Unlike equity markets, there is no “central” fixed-income exchange. Instead, securities are still traded “over-the-counter” (OTC). This often requires a trading desk to strategically plan how it will either buy or sell a bond, allowing the implementation aspect of investing to potentially add value.

The high degree of intentionality required for fixed-income investment makes the use of an active management approach justifiable, as active portfolio managers can use macroeconomic, fundamental, and quantitative research to make qualitative assessments about security selection, which may lead to outperforming the benchmark index.

Conversely, the composition of a passively managed fixed-income portfolio is intended to replicate the exposures and the performance of a benchmark index and evolve with that benchmark in line with bond market issuance trends, rather than on an active assessment of the fundamental characteristics and value of any one sector relative to another.

Credit deterioration

A prominent concern among investors is that lower-rated credits now comprise a larger share of the investment-grade credit universe than in the past, more specifically, the BBB bond segment now represents over 50% of the market value of the corporate bond index; mostly at the expense of AA and A bonds within the index. The size of the BBB-rated segment has been gradually increasing over time, with a sizable shift occurring within the last decade.

Bond indices, like equity indices, are typically weighted based on market size. However, while equity indices are capitalization-weighted, meaning companies with higher market values have greater weights, bond indices are weighted by the amount of outstanding debt. Therefore, companies that issue more debt have a larger presence in the index. This leads to a scenario in passively managed bond index strategies where more investment is directed towards companies with higher levels of debt.

Actively managed fixed-income solutions benefit from fundamental research that can help managers identify deterioration or improvement in a company’s credit profile before the rating agencies do, and even before the shift is priced in by markets. Through deeper analysis of a company’s leverage ratios, the manager can understand whether a company can service its debt and how committed its senior management is to an investment-grade rating.

How dispersion shapes fixed-income market performance

Dispersion refers to the variability in returns among different securities within the same asset class. Fixed-income markets are characterized by diverse securities, ranging from government bonds and corporate bonds to mortgage-backed securities and municipal bonds. Dispersion arises from differences in credit quality, sector dynamics, interest rate sensitivity, and issuer-specific factors; ultimately playing a crucial role in driving the performance of individual securities and the overall fixed-income asset class.

Dispersion serves as a fertile ground for active fixed-income managers to generate alpha by identifying mispriced securities, exploiting inefficiencies, and capitalizing on divergent market trends. By leveraging rigorous credit analysis, sector rotation, security selection, and risk management strategies, active managers can navigate dispersion-driven market dynamics and deliver superior returns relative to passive strategies and benchmark indices.

Performance of Active vs Passive Bond Funds

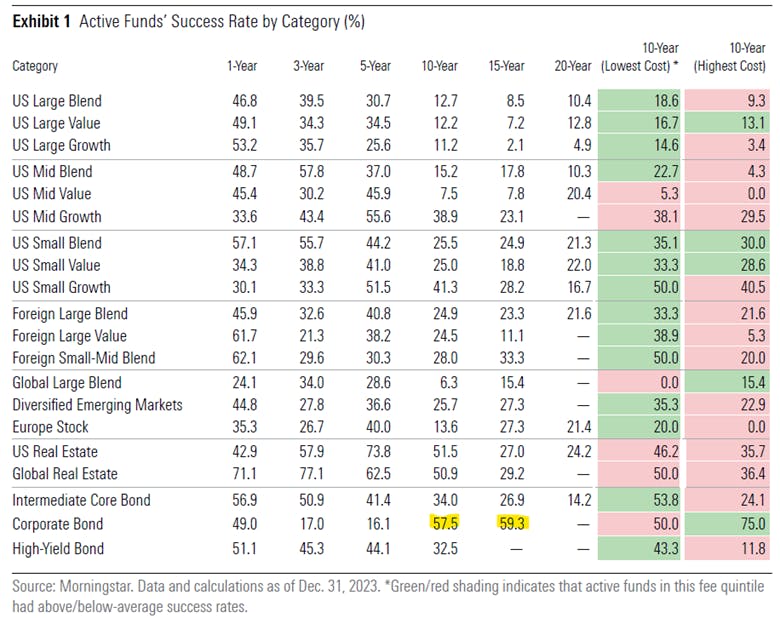

Recently, Morningstar released their 2023 active/passive barometer, a semiannual report that measures the performance of active funds against passive peers in their respective Morningstar Categories. In 2023, active U.S. bond funds fared better than average, as nearly 53% of active fixed-income funds outperformed passive funds, up from 30% a year prior.

The basis for the strong performance of actively managed funds stemmed from intermediate core bonds fund - bond portfolios investing primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, and holding less than 5% in below-investment-grade exposures – taking more credit risk than their passively managed peers. That extra dose of risk likely aided active intermediate-core funds in 2023 after hurting them in 2022, as markets rewarded credit risk after punishing it the year prior. In taking a broader look, the fixed income category where active funds have had over a 50% success rate over the past 10 years was corporate bonds; having a 57.5% and 59.3% success rate over 10 years and 15 years, respectively.

Investing in active fixed income ETFs

For investors seeking ETF solutions that are actively managed and focused on corporate debt, the following solutions fit said criteria and are worthy of consideration.

Dynamic Active U.S. Investment Grade Corporate Bond ETF (Ticker: DXBU)

This recently launched ETF by Dynamic Funds focuses on U.S. dollar-denominated investment-grade corporate bonds such that the overall weighted average credit rating of the ETF will remain investment grade. To construct a diversified portfolio, the portfolio adviser follows a disciplined bottom-up investment approach to security selection in assessing a security’s credit quality, as well as a top-down investment approach focusing on macroeconomic factors and sector analysis to actively manage the ETF’s duration, yield curve exposure, sector weightings, and individual security weightings in each segment of the credit cycle.

As of March 31, 2024, the fund has an average credit rating of ‘A-‘ and a yield to maturity of 5.43%. As noted in the name, the fund’s current allocation to U.S. corporate bonds is 83%. Given that the fund was recently launched, it has under one year of performance.

RBC Short Term U.S. Corporate Bond ETF (Ticker: RUSB/RUSB.U)

The ETF invests primarily in an actively managed portfolio of high‑quality short‑duration bonds issued in the U.S. market by U.S. corporations. These bonds are selected by the manager based on company credit and industry analysis to identify investment opportunities offering higher probabilities of competitive rates of return while simultaneously mitigating interest rate risk.

As of April 17, 2024, the fund has an average credit rating of ‘BBB+’ and a yield to maturity of 5.67%. Regarding performance, as of April 17, 2024, year-to-date performance is 3.87%, 1-year is 7.62%, and 3-year is 10.24%.

TD Select U.S. Short-Term Corporate Bond Ladder ETF (Ticker: TUSB/TUSB.U)

The ETF seeks to earn a high rate of interest income while preserving capital through exposure to the performance of a diversified portfolio of primarily U.S. investment-grade corporate bonds, divided into five groupings with staggered maturities from approximately one to five years. In seeking to achieve this objective, the fund uses fundamental credit research and quantitative screens to select corporate bonds. The Fund may also invest in non-investment-grade bonds to enhance total returns.

The portfolio manager will use fundamental credit research and quantitative screens to narrow the universe of U.S. dollar-denominated corporate bonds rated BBB or higher to create a “selection universe”. As of April 17, 2024, the yield to maturity of 5.48%. Regarding performance, as of April 17, 2024, year-to-date performance is 4.01%, 1-year is 5.62%, and 10-year is 10.25%.

Please note this article is for information purposes only and does not in any way constitute investment advice. It is essential that you seek advice from a registered financial professional prior to making any investment decision.