Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.

Growth stocks are companies that are anticipated to grow at a pace well beyond that of the broader market. These companies generally reinvest their earnings for short-term growth. Investors in growth stocks are generally focused on capital appreciation as a primary source of returns, as opposed to dividends.

For investors seeking stocks with significant upside potential, here's a closer look at three analyst-recommended companies that look appealing at current levels.

Trip.com Group Ltd (TCOM) is a multinational digital travel agency, with its headquarters in Singapore. Operating in more than 200 countries and with a network of 1.4 million hotels, they serve more than 400 million customers, with brands such as Trip.com, Qunar, MakeMyTrip, SkyScanner, and Travix.

Trip.com’s stock is down more than 4% over the last 52 weeks, significantly underperforming the broader equity markets.

In its recent Q3 results, Trip.com almost doubled its revenue, which rose 99% YoY to $1.9 billion. Earnings tripled from the year-ago period to $1 per share, comfortably beating consensus estimates of $1.8 billion in revenue on earnings of $0.67 per share.

During the quarter, domestic hotel bookings spiked by 90%, while air and outbound hotel bookings recovered to 80% of pre-Covid levels. Despite the stronger-than-forecast report, TCOM shares fell after earnings as fourth-quarter guidance disappointed, and Nomura downgraded the stock from “Buy” to “Neutral."

Looking ahead, analysts expect TCOM to book forward revenue growth of 31.6%, which is well above the consumer discretionary sector median of 5.25%. EPS for fiscal 2024 is expected to rise nearly 20% year-over-year.

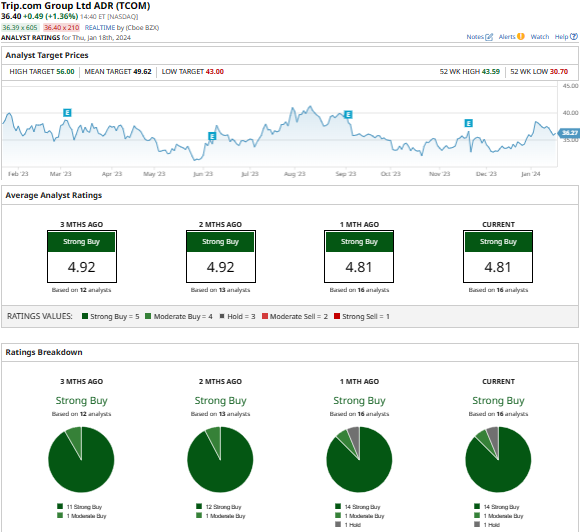

Analysts are optimistic about Trip.com’s stock, which has a mean price target of $49.62 - representing a roughly 38% upside potential. Wall Street has a consensus “Strong Buy” rating on the stock, with 14 handing out a “Strong Buy” rating, 1 suggesting a “Moderate Buy” rating, and 1 recommending “Hold.”

Carnival Corp. (CCL) is a global leader in contemporary cruising. They travel to all major vacation destinations, with a fleet of 90 cruise ships visiting 700 ports around the world. The company has 9 cruise brands under their portfolio, including Carnival Cruise Line, Princess Cruises, Holland America Line, and Costa Cruises. The company serves more than 13 million guests annually, which accounts for nearly half of the global cruise market.

CCL stock is up 71.3% over the past 52 weeks, but still trades at a steep 76% discount to its all-time highs, set in 2018.

In late December, Carnival reported its Q4 and full-year results, featuring all-time high revenue of $21.6 billion. Booking during Black Friday and Cyber Monday reached an all-time high, which CEO Josh Weinstein attributed to increased advertisements and “true organic demand.”

Carnival also reduced its debt load by repaying $6 billion during Q4, and ended the year with liquidity of $5.4 billion.

After breaking even on a per-share basis in fiscal 2023, Wall Street expects CCL to report a profit of $0.98 per share this fiscal year. Forward revenue growth is pegged at 28.3%, easily outpacing the sector median.

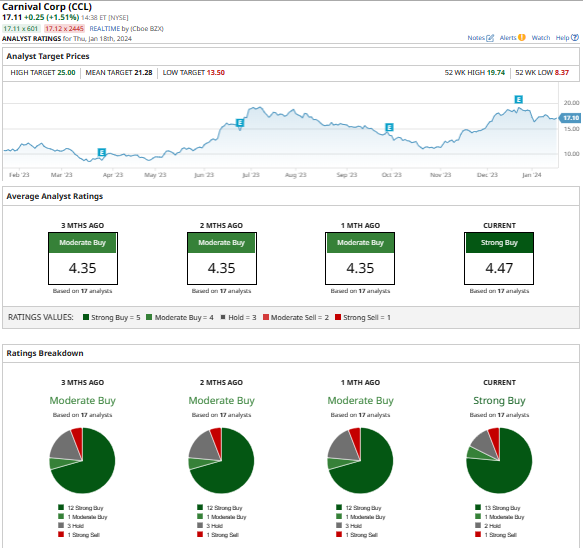

Analysts are bullish on Carnival’s stock, with a consensus “Strong Buy” rating. Of the 17 analysts covering the stock, 13 have a “Strong Buy” rating, 1 has a “Moderate Buy” rating, 2 have a “Hold” rating, and 1 has a “Strong Sell” rating. Carnival has a mean price target of $21.28, implying upside potential of 22.7% from current levels.

Live Nation Entertainment (LYV) is a live entertainment company, primarily focused on producing concerts and selling tickets. It operates in 48 countries, and sells more than 550 million tickets annually to more than 44,000 concerts and 100+ festivals. It operates in five segments: Ticketmaster, Artist Nation, House of Blues, Media & Sponsorships, and Concerts.

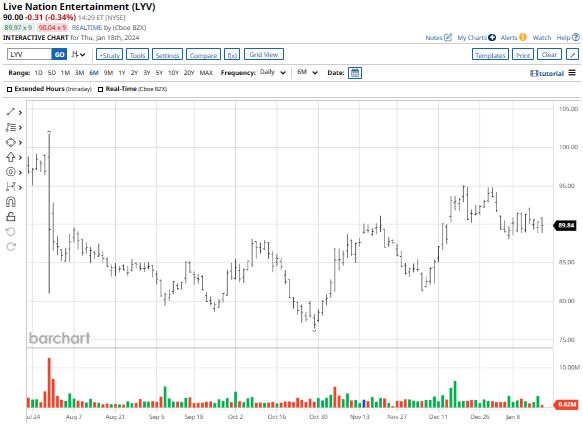

Live Nation’s stock is up 24.5% over the past year, right on pace with the broader market.

The company posted record Q3 results, with earnings coming at $1.78 per share (versus an estimated $1.27) and revenue up 32% YoY to $8.2 billion - way beyond Wall Street's estimated $6.89 billion. Concert ticket revenue ramped up 32% year-over-year to $6.97 billion, as LYV sold 155.4 million tickets globally during the period.

Forward revenue growth for LYV is estimated at 55%, compared to the communications services sector median of 3.7%. EPS is expected to rise 60% this year to $2.40.

Analysts have a bullish take on Live Nation, with a consensus “Strong Buy” rating and a mean price target of $113.43. That suggests 24.4% upside potential to current levels. Out of the 14 analysts tracking the shares, 13 have a “Strong Buy” rating and 1 has a “Moderate Buy” rating.

Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.

All market data (will open in new tab) is provided by Barchart Solutions. Copyright © 2024.

Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms of use, please read disclaimer (will open in new tab).