Briefing highlights

- Canadian dollar tops 81 cents

- U.S. currency on the back foot

- Markets at a glance

- Aurora in deal for CanniMed

- Forget about that fat raise

- British employment at record

The weak dollar is a tide that lifts all boats

Mark McCormick, TD Securities

The Canadian dollar has cracked the 81-cent (U.S.) mark as the U.S. currency takes it on the chin.

"The [Canadian dollar's] movements are in line with broader developments in the [foreign exchange] markets - and that means strengthening against a weaker USD," said Bipan Rai, executive director of macro strategy at CIBC World Markets.

"Treasury Secretary Mnuchin's comments last night in Davos are an indication that the administration's support for the 'Strong Dollar' policy is the weakest it's been in decades. That could have long-term implications, but for now it means that the market is offloading USD, which we regard as 8 to 10 per cent overvalued on a trade-weighted basis."

IG chief market analyst Chris Beauchamp listed the evens of the past few days and some new numbers today, from the U.S. government shutdown to British employment numbers, noting that "all these are as nothing compared to" what happens to the U.S. dollar.

"At present it is not so much the 'almighty dollar' as the 'powerless dollar,' with the weakness in the currency coming as a reminder that, just as equity markets can keep going up, a currency can keep falling."

The Canadian dollar, in turn, traded between 80.5 cents and 81.19 cents, and was above the 81-cent mark by late afternoon.

"The case for the continuation of the [U.S. dollar's] medium-term downtrend rests in the introduction of tariffs on washing machines and solar panels," Mr. McCormick said.

"These are clearly marginal industries in the context of U.S. GDP, but the real signal is the possible pivot towards trade," he added.

"This will keep the market on high alert for signs of America-first language in Trump's speech at Davos."

Still out there, of course, are negotiations to overhaul the North American free-trade agreement, which can, and have, made the loonie jumpy.

And it comes in the wake of Canada agreeing to a Comprehensive and Progressive Agreement for Trans-Pacific Partnership, a somewhat fancy name for the trade deal Ottawa snubbed earlier.

Wednesday's agreement "represents a change of heart" after Ottawa fretted that joining in could upset its stance in NAFTA talks, but "Canada's signing of the CPTPP could suggest the government not expect a successful renegotiation of NAFTA any time soon," said Sue Trinh, Royal Bank of Canada's head of Asian foreign exchange strategy in Hong Kong.

Ms. Trinh also cited the growing spread between Western Canada select crude and West Texas Intermediate, the U.S. benchmark.

"We still think risks to CAD on NAFTA talks are asymmetric to the downside," she said, referring to the loonie by its symbol.

"Adding to our view, the WCS discount to WTI has hit a new four-year high of $27.50/barrel amid high Canadian production and pipeline shortages that keep Canadian producers from reaping the full benefits of the global oil rally and suggests the gravitational pull for [the U.S. versus the Canadian dollar] is higher."

Read more

- Follow our Inside the Market

- Scott Barlow: Why a sharply lower Canadian dollar appears to be on the horizon

- NAFTA ‘tape bombs,’ interest rates and the risk of a 70-cent Canadian dollar

Aurora in deal for CanniMed

A merger today in the marijuana field, first reported by The Globe and Mail's Christina Pellegrini and Jeffrey Jones: Aurora Cannabis Inc. has struck a cash-and-stock takeover deal for CanniMed Therapeutics Inc.

The deal is worth about $1.1-billion, based on Aurora's "implied share price" of $12.65, for a total $43.

It caps a two-month takeover battle between the two medical marijuana companies.

Read more

- Christina Pellegrini: Aurora, CanniMed end row with $1.1-billion pact

- Christina Pellegrini, Jeffrey Jones: Aurora nears $1-billion takeover deal for CanniMed: sources

Markets at a glance

Read more

Forget about that fat raise

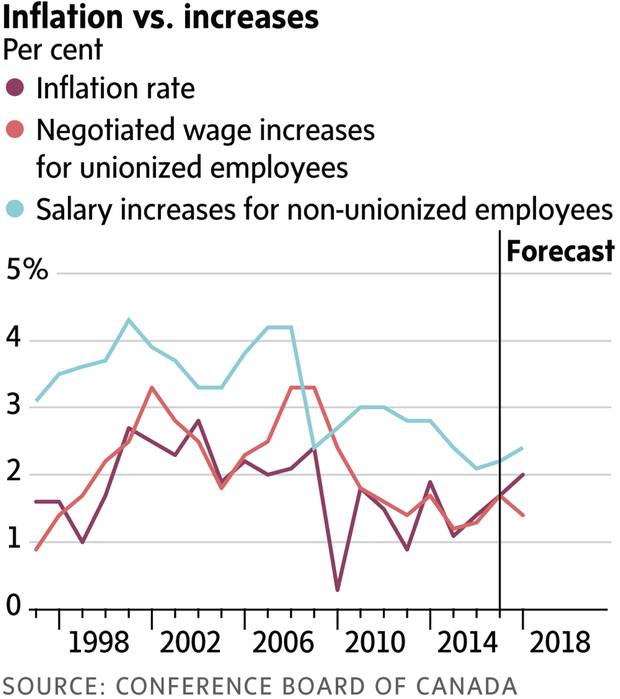

Expect lines in the sand over pay levels this year, be it at the bargaining table or across the desk from your boss.

"Despite strong economic growth and record-breaking employment numbers, lingering uncertainties in the global economy will create a challenging bargaining environment in 2018," the Conference Board of Canada said in its latest outlook.

Salaried employees will fare better than their unionized counterparts, and private-sector workers will outpace those in the public service. And, importantly, many of us will fall behind by failing to keep pace with inflation, warned network manager and research associate Monica Haberle.

Canada's economy may have rebounded last year, but "this pace of growth is likely to be unsustainable, and an unpredictable global climate is keeping pay plans modest going into 2018," Ms. Haberle said.

"Upcoming legislation changes in a number of jurisdictions across the country will make for a challenging bargaining environment in 2018," she added.

"In addition, the pending legalization of recreational cannabis use – along with concerns about its medical use – add to these complexities."

Consider it a cold war – my words, not Ms. Haberle's – because management-union relations appear solid and few see strikes or lockouts in the horizon.

The Conference Board included previously reported findings in its outlook, based on a survey of more than 300 organizations and a roundtable with management and labour:

The average increase in base pay for non-unionized employees will be 2.4 per cent, a shade better than last year's 2.2 per cent and a real raise given that the Bank of Canada forecasts inflation of about 2 per cent.

Those in the private sector, at 2.5 per cent, will do better than their public-sector peers, who will match inflation at 2 per cent.

Canada's unionized work force, however, will fall behind, with the average negotiated wage increase forecast at just 1.4 per cent, which is not only low but also lower than 2017's 1.7 per cent.

Again, there's a private-public divide, with the former at 1.7 per cent and the latter at just 1.1 per cent.

And for some, that may be the good news.

"Three per cent of organizations are planning a base pay freeze across all non-unionized employee groups in 2018," Ms. Haberle said in her report, noting, too, a regional divide.

"For example, range and salary freezes in 2017 and 2018 are largely concentrated among organizations in Alberta, Saskatchewan, and the Atlantic region," she said.

"Forty per cent of organizations in Saskatchewan plan to hold ranges constant in 2018, along with 34 per cent of organizations in Alberta. Ten per cent of organizations in Alberta also plan to freeze salaries."

Projected raises for salaried employees will be highest in Manitoba, at 2.6 per cent, with Ontario and Quebec close behind, at 2.5 per cent.

There are also employers with short-term incentive pay.

"Wages continue to be the top bargaining issue for both management and unions, as has been the case for a number of years," Ms. Haberle said.

"However, flexible work practices are now the next most common issue for employers - outpacing productivity, business competitiveness, and organizational change," she added.

"This is the first time that flexible work practices have been a top three negotiation issue for management in almost a decade. Other top negotiation issues for management for the coming year include productivity and business competitiveness, both of which align with organizational needs to evolve along with changing technologies and to adapt in the complex global climate."

On the labour side, unions say pay, job security and benefits are their key issues for the year.

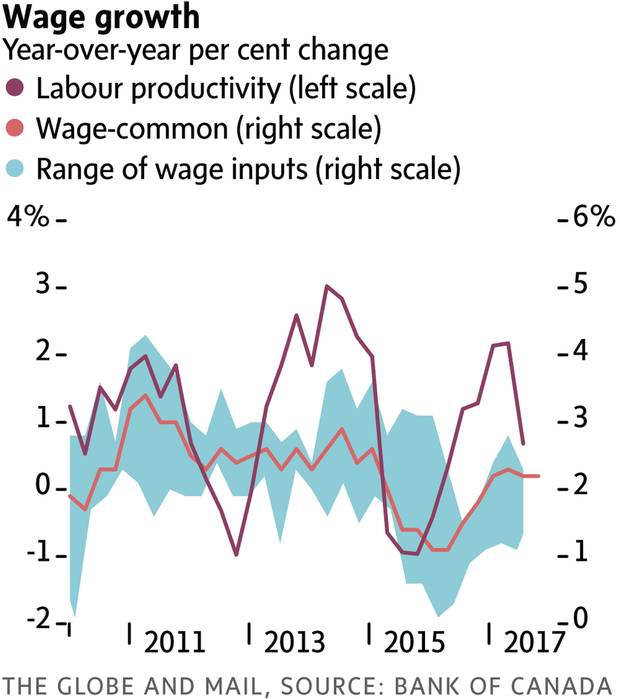

The Bank of Canada has also flagged the pay issue.

"While wage growth has improved, underlying wage pressures remain modest," the central bank said in its latest monetary policy report, or MPR.

"The rapid pace of hiring and swift decline in the unemployment rate in the past few months indicate that labour market slack is being absorbed more quickly than expected," it added.

"However, several other factors are expected to constrain wage gains despite recent increases in minimum wages."

And there may be even less than meets the eye.

"The bank warned in its MPR that underlying nominal wage growth is tracking just over 2 per cent annually," said David Madani, senior Canada economist at Capital Economics.

"After adjusting for inflation, that means there's little growth in real wages. That's probably on the low side, we suspect, judging by our own analysis of the underlying trends in compensation and labour productivity."

Despite bargaining challenges, management-union relations "do not appear to be strained," according to the Conference Board report, with both sides willing to work co-operatively.

"Almost half (49 per cent) of organizations describe their union-management climate as co-operative, and only six per cent believe the relationship to be somewhat unco-operative," Ms. Haberle said.

Having said that, 10 per cent of the organizations surveyed expect that level of co-operation to erode this year or next, though most do not and some expect to see even better relations.

Ninety per cent foresee no work stoppage, and fewer than 2 per cent consider one likely, at all.

Read more

- 2018 consumer math: 2% inflation + 1.4% pay raise = you’re screwed

- Rachelle Younglai, Murat Yukselir: Who are Canada’s 1 per cent and highest paid workers?

- Rachelle Younglai: The missing middle

- Follow Globe Careers

More news

- Aurora nears $1-billion takeover deal for CanniMed: sources

- U.K. employment surges to record high, wages edge up