Briefing highlights

- Trade tensions promise sweeping fallout

- Canadian dollar forecast to slump further

- Pembina Pipeline strikes deal for Veresen

- What to expect from the Fed this week

- What to watch for in jobs reports

- What else to watch for: Toronto housing bubble

America's most wanted

It’s as though Canada has suddenly become America’s “number one trade villain,” as Bank of Montreal puts it.

And the fallout promises to be sweeping even if the Trump administration’s latest shots don’t mark the beginning of an all-out trade war, as the U.S. promises and many observers believe.

Tensions are mounting in advance of renegotiating the North American free-trade agreement. President Donald Trump is taking swipes at the Canadian dairy, lumber and energy sectors. The U.S. Department of Commerce is slapping duties on softwood, and Boeing wants similar action against Bombardier.

And key in all this is that the Department of Commerce is suddenly emboldened by Mr. Trump’s trade agenda and rhetoric.

“We’re going to get a deal, and we’re going to negotiate,” trade lawyer Peter Kirby, a partner at Fasken Martineau, said of NAFTA.

“What’s more troublesome is taking the reins at the Department of Commerce and putting people in charge who are anti-free trade.”

One of the threats, Mr. Kirby warned, is to Canada’s attempts to lure investment from businesses that want access to the U.S. via NAFTA.

It will be harder now to attract such investments because “that access to the U.S. market is now looking a lot less certain.”

Carlos Capistran, the Canada and Mexico economist at Bank of America Merrill Lynch, also warned of the threat, noting that Mr. Trump still says he’ll kill NAFTA if he doesn’t get a good deal, which should be obvious.

“So risk of termination remains, and renegotiation outcomes are uncertain, especially as domestic politics will be involved – for instance Mexico has presidential elections in July 2018,” Mr. Capistran said.

“This will keep market volatility high and delay investment.”

This has all come on fast, and shouldn’t be all that surprising because negotiating tactics are at play.

But then again, it wasn’t that long ago that Mr. Trump said NAFTA only needed tweaking where Canada’s concerned.

“In fact, he said ’wreaking havoc,’” said BMO chief economist Douglas Porter.

“Somehow, Canada has suddenly replaced Mexico as the number one trade villain in some U.S. eyes, morphing from an ‘outstanding trading partner’ to a ‘disgrace’ in a few short steps,” he added in a report.

“That’s despite the well-documented fact that Canada is the number one U.S. export market, and runs as close to balanced bilateral trade as any major economy with America. And, including services, the U.S. is in a rare overall surplus position with Canada. But these alternative facts seemingly make little impression.”

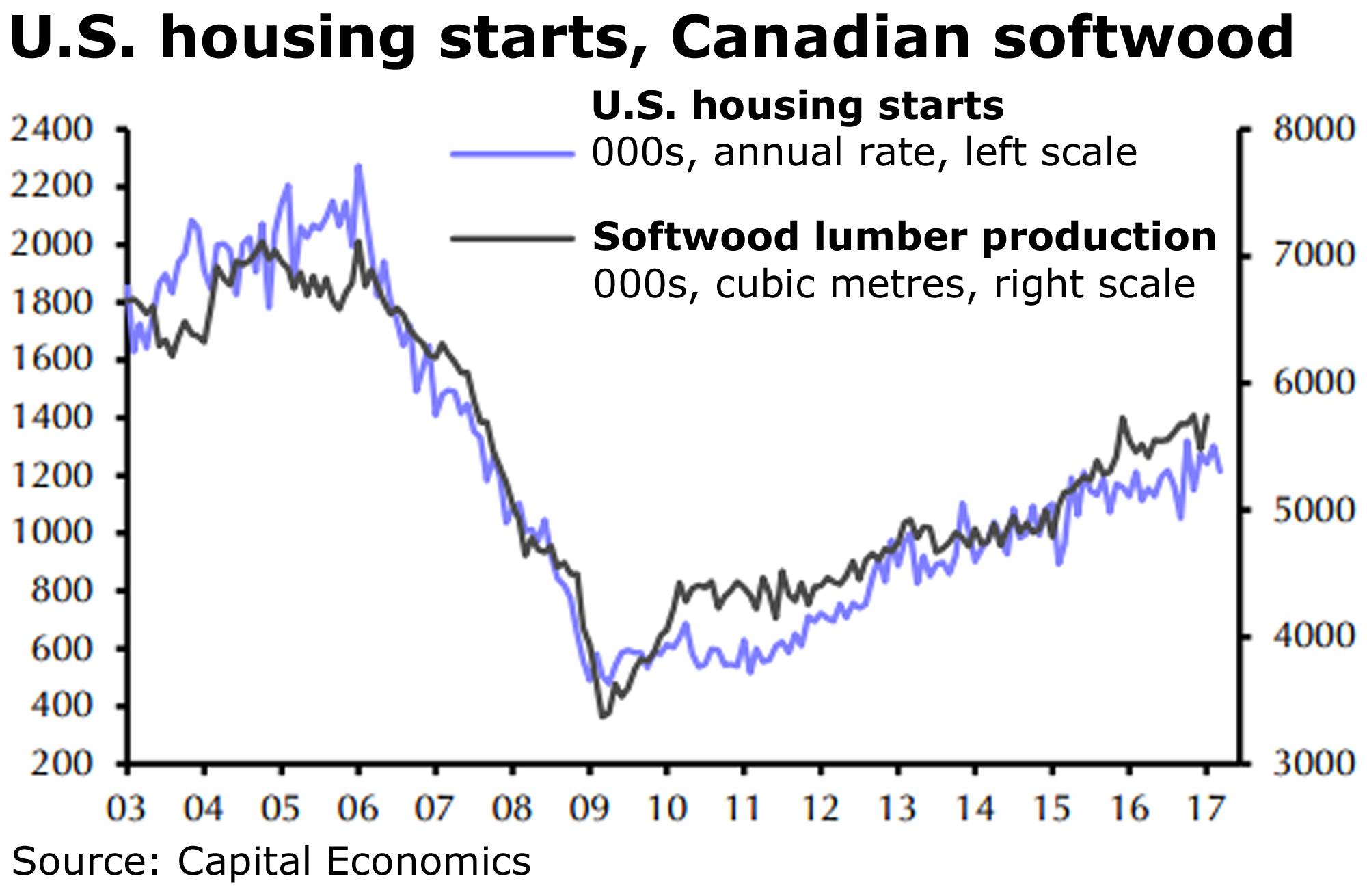

At this point, many analysts say they’re not overly troubled by the impact of the softwood duties. Levies were likely to be imposed no matter who was in the White House, and are the latest in a long-running dispute.

Lumber prices are already well up from a year ago. And, noted economist David Madani, the U.S. construction industry is strong.

Not only that, Mr. Trump and Prime Minister Justin Trudeau “appear very keen” to solve their trade issues, said Mr. Madani, senior Canada economist at Capital Economics.

“More importantly, we don’t believe that the softwood lumber dispute is the start of a major trade war between the U.S. and Canada.”

That’s if all the fuss is limited to softwood and NAFTA results that don’t hurt too much, of course.

“While it is highly unlikely NAFTA will be revoked, it is certain the U.S. will continue to take an increasingly protectionist stance,” said geopolitical analyst Alex Katsoras of National Bank of Canada.

“This will be driven by the fact that opposition to free trade is one of the few things that unites an otherwise deeply divided U.S. electorate,” he added.

“In this environment, investors must do more than simply analyze the balance sheets of companies. They must also look at any ongoing or potential future tensions with trading partners, since access to foreign markets should no longer be taken for granted. The lumber sector is a case in point.”

Remember, too, that it’s not just Mr. Trump, who might otherwise be discounted given his flare for such rhetoric were he a lone voice.

“The rhetoric/bullying is having a real impact on financial markets,” BMO’s Mr. Porter said.

“Commerce Secretary Wilbur Ross, who is charged with overseeing the trade file, lashed Canada for ‘dumping lumber” and ‘subsidizing mills’ as he announced a near 20-per-cent tariff on Canadian softwood lumber,” Mr. Porter added.

“Not to quibble, but the common definition of dumping is selling in export markets below domestic prices and/or below cost, neither of which seems to be the case in this dispute. And, the triple threats to softwood lumber, the dairy industry, and NAFTA broadly sent the Canadian dollar spinning.”

Dead or alive

It’s true that oil prices and monetary policies are playing a role in the Canadian dollar’s demise, but loonie bears certainly have a (wood) chip on their shoulders.

The announcement of the lumber duties knocked the loonie down last week, and it all threatens to get worse.

Canada now has a 73-cent dollar, and many analysts see the currency eroding further, to about 71 or 72 cents U.S.

“The biggest known risk reared its head [two weeks ago] in Trump’s disparaging remarks on Canada’s dairy sector,” said Toronto-Dominion Bank senior economist James Marple.

“[Last] week it was in concrete actions against softwood lumber,” he added.

“While alone these two sectors are too small to derail the overall macro-economic outlook, the fear is they are the tip of the iceberg. As these actions played out, rumours swirled that the administration was preparing an executive order to withdraw from NAFTA outright. This didn’t happen, but Trump’s promise to renegotiate (after entreaties from Canadian and Mexican leaders) left the threat in place.”

Speculators are also ganging up on the Canadian dollar, raising their bets against the loonie for several weeks in a row, according to the latest data from the U.S. Commodity Futures Trading Commission.

The net short position against the currency has fattened to $3.1-billion, according to the numbers, released on Friday and measured as of last Tuesday.

Given that the snapshot was as of Tuesday, it means the numbers are “post-lumber, pre-NAFTA-U-turn,” said Scotiabank foreign exchange strategist Eric Theoret.

CIBC World Markets chief economist Avery Shenfeld expects the loonie could regain a couple of pennies by the end of the year, but that wouldn’t make the currency a “screaming buy,” and it’s still under threat, anyway.

“The tempest that is the Donald Trump White House is unpredictable, and still poses a meaningful threat to Canadian export flows,” Mr. Shenfeld said.

“Even the dreaded ‘border adjustment tax’ hasn’t completely been put to bed, since some in Congress will still be looking for revenues to offset deep cuts to U.S. corporate and income taxes,” he added.

“For importers, hedging strategies that allow for participation in a Canadian dollar recovery, but protect against a larger depreciation, look attractive given the veil of uncertainty still hanging over us.”

Pembina to buy Veresen

Pembina Pipeline Corp. has struck a deal for Veresen Inc. valued at almost $10-billion when the latter’s debt is included.

Pembina is offering either 0.4287 of a share or $18.65 cash, the Canadian companies announced today.

“We believe combining these two organizations augments our ability to compete for future investment opportunities and execute on a larger, more complex suite of opportunities than each company on a standalone basis,” Veresen chairman Stephen Mulherin said in a statement.

What to watch for this week

Oh, it’s a busy one.

We’ll get the latest from the Federal Reserve, learn how Canada’s jobs market is faring, and talk about our favourite subject, Toronto’s housing bubble.

First, the U.S. central bank won’t change its key rate when it unveils its decision Wednesday. And there’s no news conference with chair Janet Yellen so markets will take their cue from the policy statement alone.

“The statement should be fairly brief and remain on course, with a substantial portion of the language used in the last statement in March,” said Derek Holt, Bank of Nova Scotia’s head of capital markets economics.

Markets, of course, are trying to gauge the timing of the next rate hike, and how many increases we’ll get from the Fed this year.

“The scope for surprise from a central bank that tends to prefer to have markets and consensus lined up more favourably in advance of policy changes is probably very low,” Mr. Holt said.

“Given the distance to the next meeting on June 14, a direct signal on hiking at that meeting is also unlikely. Markets are pricing about two-thirds odds to a hike then.”

Friday brings us the latest look at the jobs market from Statistics Canada.

As always, economists differ in their forecasts, expecting to see that anywhere from about 10,000 to 20,000 jobs were created in April, with unemployment holding at 6.7 per cent.

“The Bank of Canada has been stressing hours worked rather than employment, so keep an eye on that detail, even though we are suspicious about the accuracy of this household survey as a source for that series,” said CIBC’s Mr. Shenfeld.

The U.S. employment report will be released at the same time, and economists expect to see job creation just shy of 200,000 and an unemployment rate of 4.6 per cent.

We’ll also get the Toronto Real Estate Board’s monthly measure of sales and prices mid-week.

Economists have no projection for the April report, but here’s mine: Prices in the Greater Toronto Area surged again in April, heightening concerns over a housing bubble and lending weight to the Ontario government’s recent measures to do something about it.

There’s a lot more, too, over the next several days:

Today

Coming in throughout the morning will be purchasing managers index readings from around the world, which will help paint a picture of the global economy.

Also on tap are quarterly results from several companies, including Matinrea International Inc. and Tembec Inc.

Westshore Terminals Investment Corp. also reports, and will no doubt have something to say after its stock plunged last week when Premier Christy Clark urged Prime Minister Justin Trudeau to ban thermal coal from B.C. ports.

Tuesday

Earnings on tap: Anadarko Petroleum Corp., Apple Inc., Athabasca Oil Corp., Cineplex Inc., ConocoPhillips Co., Devon Energy Corp., Fortis Inc., Genworth MI Canada Inc., Kinross Gold Corp., MacDonald Dettwiler & Associates, MasterCard Inc., Merck & Co., Pengrowth Energy Corp., Pfizer Inc. and WestJet Airlines Ltd., among others.

Wednesday

The euro zone reports first-quarter economic growth, which observers at Royal Bank of Canada expect to come in at 0.4 per cent, and possibly better.

“Euro area survey data has been universally strong since the turn of the year; the average composite PMI for Q1 was the highest in six years and is pointing to GDP growth of 0.5 to 0.6 per cent in Q1,” they said.

“However, harder data has yet to reflect the improved sentiment; outside Germany, industrial production is likely to act as a drag on growth despite stronger manufacturing PMIs.”

Besides that and the Fed’s 2 p.m. ET decision, many more companies are reporting: Alibaba Group Holdings Ltd., CGI Group Inc., Canadian Natural Resources Ltd., Cascades Inc., Facebook Inc., Humana Inc., Kraft Heinz Co., Loblaw Cos. Ltd., Manulife Financial Corp., Tesla Inc., Time Warner Inc., Torstar Corp., Trican Well Service Ltd. and Western Forest Products Inc.

Investors will also get a look at the books of embattled Home Capital Group Inc.

Thursday

A busy day, this one, starting with Mr. Trump’s favourite subject.

We’ll get the latest monthly trade reports from Canada and the U.S., which come amid all the threats and trade actions.

Economists expect Canada’s merchandise trade deficit to narrow somewhat, to $800-million (Canadian), and for the U.S. goods and services deficit to widen to almost $45-billion (U.S.).

“The Canadian dollar backed off from 18-month highs, which should provide some support to exporters,” BMO senior economist Benjamin Reitzes said of Canada’s numbers.

“We’ll be watching electronic and electrical equipment import volumes, which have a strong correlation with machinery and equipment investment and have slumped for the past two years,” he added.

“We’ll also be watching non-energy export volumes closely as usual, as they’ve failed to gain traction over the past two years.”

And speaking of NAFTA, Bank of Canada Governor Stephen Poloz speaks in the afternoon to a business group in Mexico City.

Earnings galore: Anheuser Busch InBev SA, Autocanada Inc., Baytex Energy Corp., Berkshire Hathaway Inc., Canadian REIT, Dorel Industries Inc., Great-West Lifeco Inc., Husky Energy Inc., Hydro One Ltd., Occidental Petroleum Corp., Penn West Petroleum Ltd., SNC-Lavalin Group Inc., Seven Generations Energy Ltd. and Viacom Inc.

Friday

Along with the duelling Canadian and U.S. jobs reports, the Fed’s Ms. Yellen speaks in the afternoon on women in the economy.

And still some earnings: Air Canada, IGM Financial Inc., TransAlta Corp. and TransCanada Corp., whose Keystone XL pipeline has just won approval from Mr. Trump.

Want to interact with other informed Canadians and Globe journalists? Join our exclusive Globe and Mail subscribers Facebook group