The ‘cheap’ loonie

It will be interesting to see what the Bank of Canada has to say tomorrow given the sharp rebound in the loonie.

The stronger-but-still-weak Canadian dollar, which the central bank hopes will help power the country’s exports, is sitting at about 75 cents (U.S.) today, having staged a marked comeback from the depths of January.

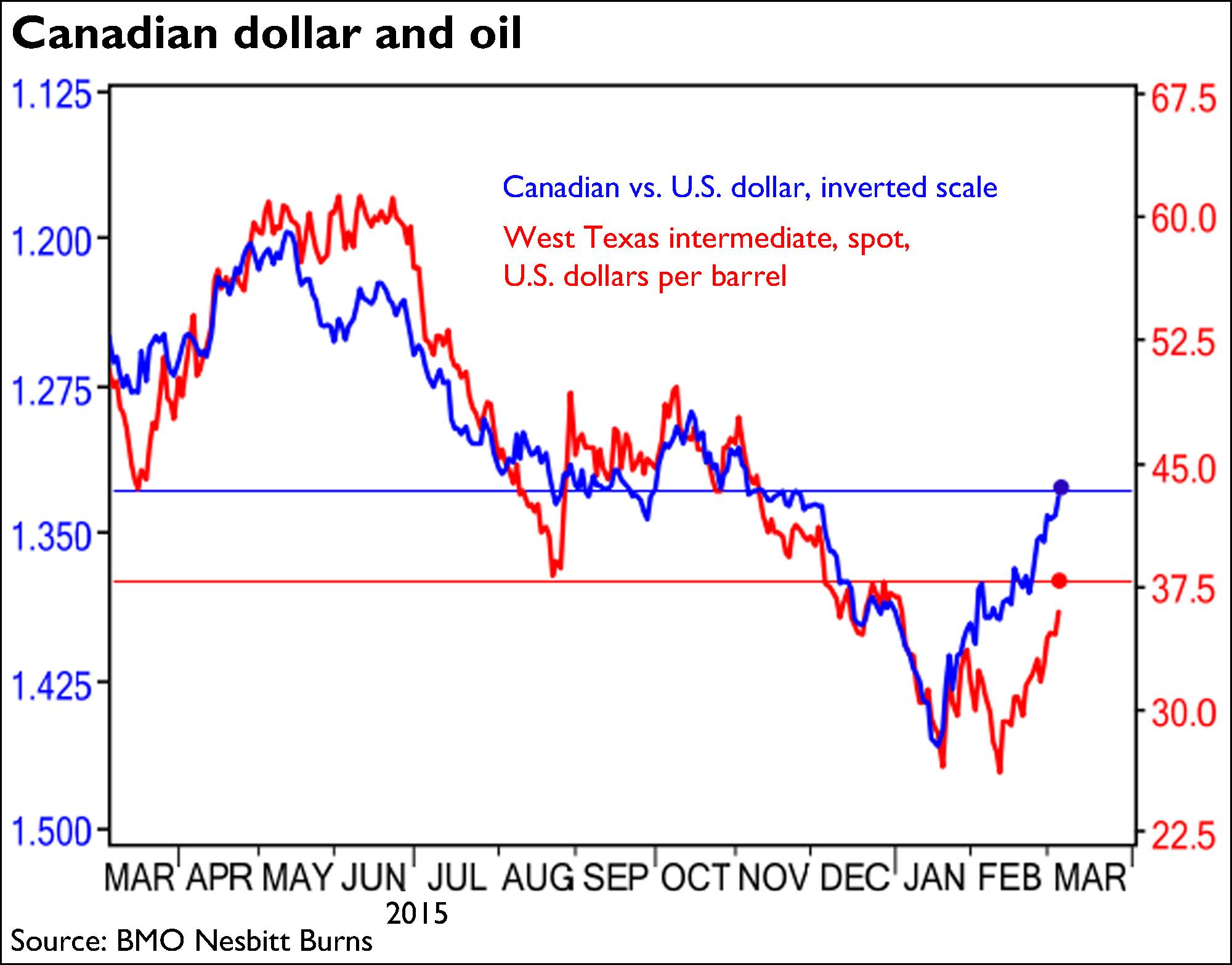

“The bounce has been more recently fueled by the sudden reversal in oil, and now other resource prices are getting into the act,” said chief economist Douglas Porter of BMO Nesbitt Burns.

“For example, copper prices are up 17 per cent from the lows in mid-January (from under $1.95/pound to almost $2.30 now),” he added.

“Still, oil is the big driver, with Brent pushing above $40 for the first time this year on Monday and [West Texas intermediate] hovering around $38.”

Bank of Canada Governor Stephen Poloz and his colleagues release their latest policy decision tomorrow, and aren’t expected to change the benchmark overnight rate from its current 0.5 per cent.

Oil isn’t the only driver of the loonie. So, too, are the strength of the U.S. dollar and speculation over the timeline of interest rate moves by the Bank of Canada and the Federal Reserve.

The loonie has “run well ahead” of the rebound in crude prices, Mr. Porter said, while the U.S. currency has softened a bit as markets wonder about when the Fed will raise rates again.

“More importantly, the market continues to price out further BoC cuts,” he added.

“We suspect the bank could sound a bit more dovish than expected this week, with a wary eye on the loonie’s recovery.”

It’s interesting, too, to look at the loonie versus other currencies, such as the euro.

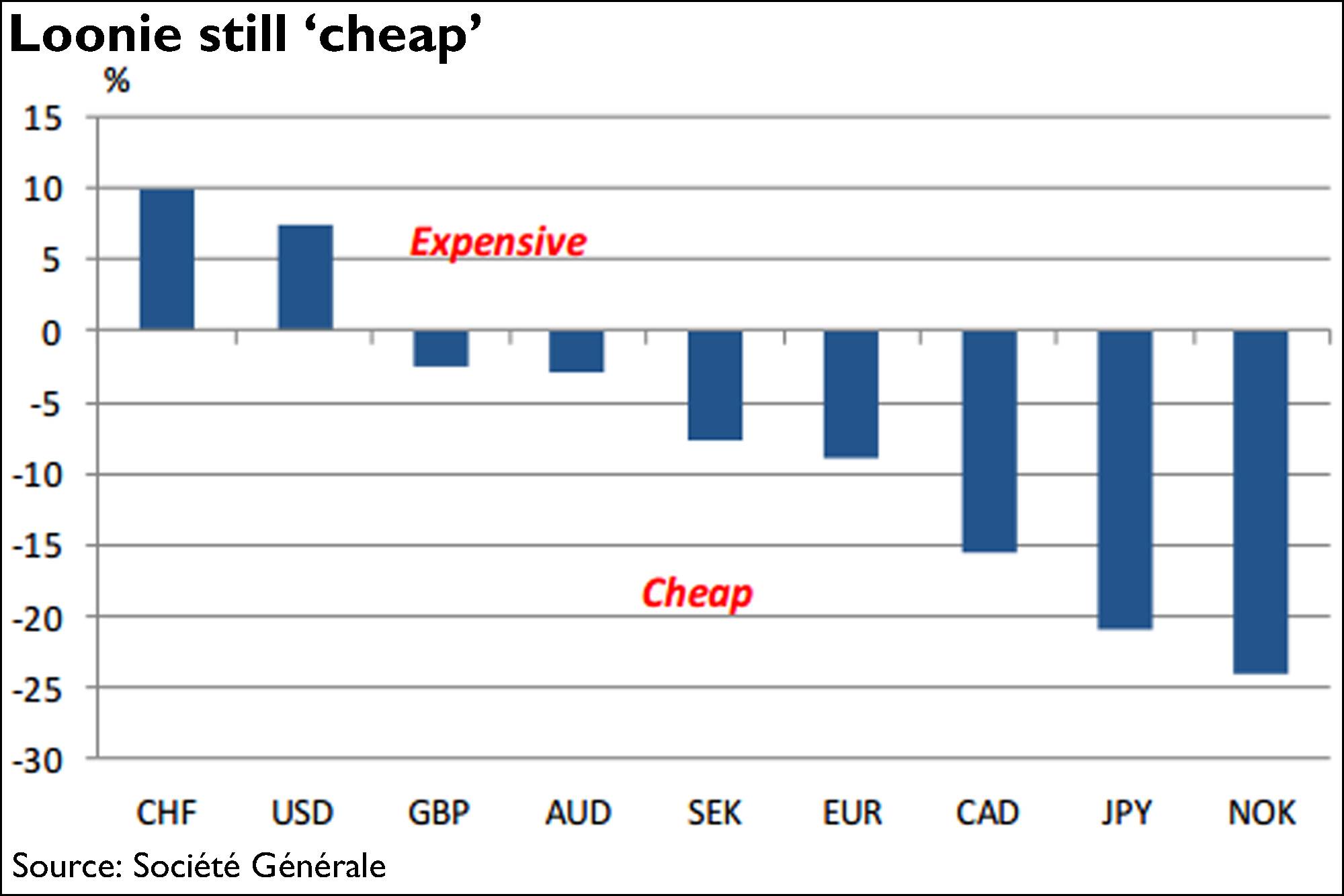

It’s about “15-per-cent cheap” against Europe’s common currency, according to Société Générale, which prepared this chart, using the symbols, from left to right, for the Swiss franc, U.S. dollar, British pound, Australian dollar, Swedish krona, euro, Canadian dollar, yen and Norwegian krone.

“The [Canadian dollar] was for a long period too expensive compared to the currencies of its trading partners when oil prices were trading north of $100,” said Société Générale strategist Kenneth Broux, citing others that gained such as the Australian dollar and Brazil’s real.

“It has now cheapened substantially in those same trade-weighted terms and has become attractive (i.e. against its major trading partners, adjusted for inflation),” he added.

“The [Canadian dollar] has scope to strengthen relative to other currencies.”

A scene I'd love to see ...

“There's something you should know about Ms. Cattrall.”

Stocks sink

European stocks are tumbling on the latest round of Chinese numbers, with New York poised to follow suit.

Tokyo’s Nikkei gained slightly today, as did the Shanghai composite, while Hong Kong’s Hang Seng lost 0.7 per cent.

In Europe, London’s FTSE 100, Germany’s DAX and the Paris CAC 40 were down by between 0.3 per cent and 0.4 per cent by about 8 a.m. ET.

New York futures were also down.

“Equity markets start the day on the back foot today after Chinese February trade data came in much worse than expected earlier this morning,” said CMC Markets chief analyst Michael Hewson.

“A sharp decline in exports of 25.4 per cent points to continued weakness in the global economy, and while some of the decline may well be down to the timing of Chinese New Year, the fact that the number missed expectations by such a long way does raise concerns that global demand could be much weaker than people realize,” he added.

“Imports also fell sharply, down 13.8 per cent, but they did improve on the January numbers, but they also missed expectations.”