Ethanol Chicago(FLF23)NYMEX

Friday's Last Call: Crude Oil's Hard Fall

- The WTI crude oil market has been in a downtrend since March 2022.

- This coincided with the beginning of interest rate increases from the US Federal Reserve and announced release of oil from the US Strategic Petroleum Reserve.

- Selling has come from both noncommercial and commercial traders as the fundamentals of the market changed.

The Three Kings of Commodities were reduced to one Jack and a couple of Jokers during Friday’s session. Corn worked its way out to a 2.25-cent higher close, though noncommercial support in the market looks to be about as sturdy as a house of cards. April gold (GCJ23) melted down to end the week, falling as much as $56.30 (2.9%) before closing $53.00 lower for the day and down $67.80 for the week. (April also completed a bearish key reversal on its weekly chart, a subject for another day.) As for WTI crude oil, the spot-month contract lost as much as $2.78 before finishing the week within sight of its low. Why the collapse in gold and crude oil? The talking heads on any financial network you choose will tell you it was all about the January nonfarm payrolls number. The funny thing is, though, if markets had moved strong the other direction after the release of these same numbers, the talking heads would still say it was all due to nonfarm payrolls.

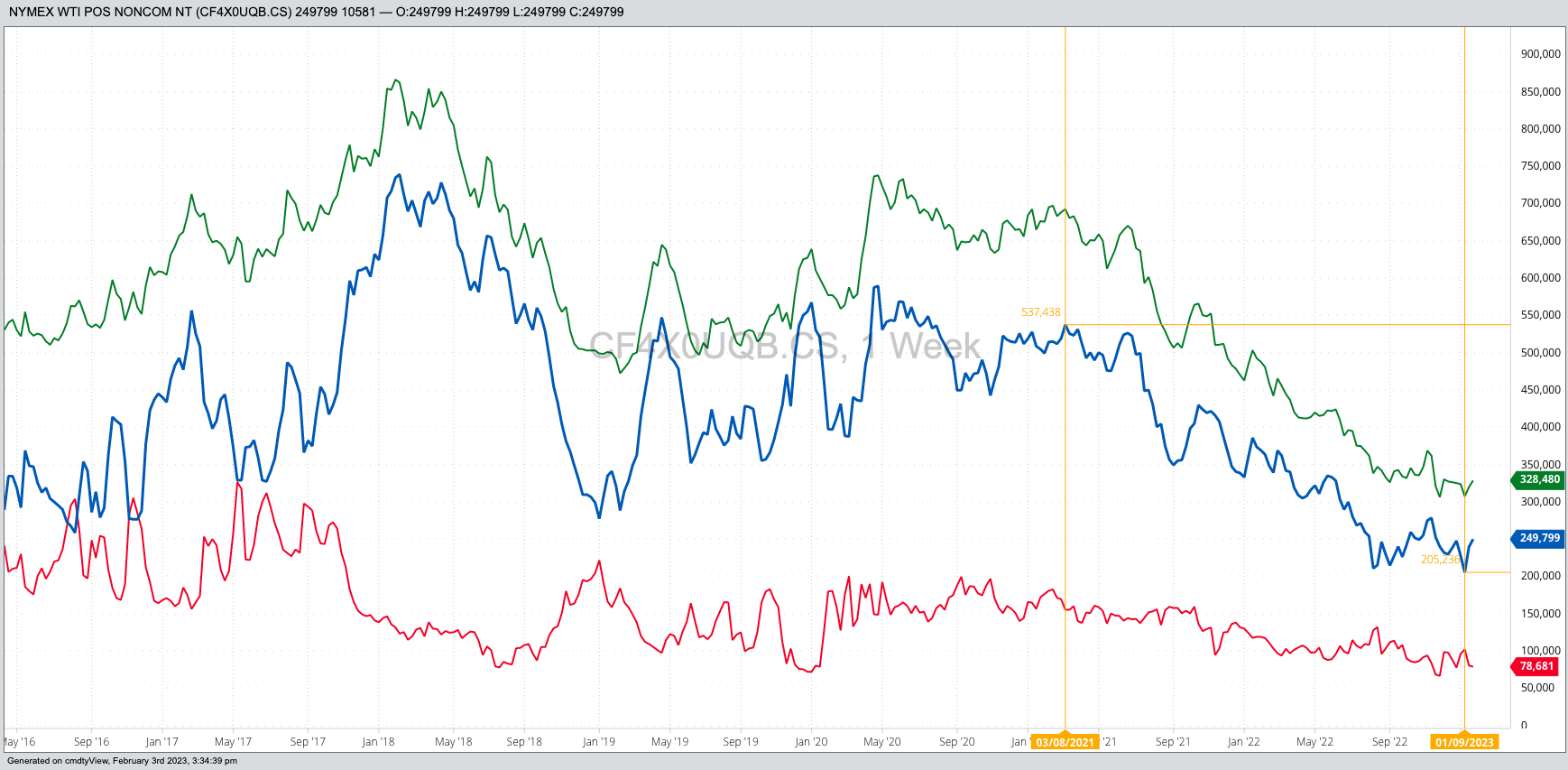

But there’s more to it than that. There always is. A look at the continuous weekly chart for crude oil (spot futures contract) shows the market has been in an intermediate-term downtrend since posting a bearish spike reversal the week of March 7, 2022. This was followed by a bearish outside range the week of June 13, 2022. So unless my once-discussed theory of Negative Time (we are where we are today because of where we will be later) has actually played out, traders didn’t start selling crude oil because of the January 2023 nonfarm payrolls number.

In fact, noncommercial (fund, speculative, algorithm, etc.) traders have been selling crude oil since early March 2022, according to CFTC Commitments of Traders report (legacy, futures only). The week of March 7 this group held a net-long futures position (blue line) of 537,438 contracts. This position was cut to 205,236 contracts the week of January 9, 2023, a decrease of 332,202 contracts. This included a decrease of 385,338 contracts of long futures (green line).

The reality is crude oil has been freefalling since the Federal Open Market Committee began raising interest rates last March. Keep in mind one of the goals of interest rate hikes is to reign in consumer spending, ultimately cooling inflation that had been allowed to get rolling the last number of years. Then, on March 31, 2022, US President Biden announced a release of 1 million barrels of oil per day from the reserve for the next 180 days. In other words, demand was being slowed by Federal Reserve interest rate hikes while supplies were being increased by releases from the US Strategic Petroleum Reserve.

Why has crude oil been in a downtrend? As Newsom’s Market Rule #7 tells, fundamentals win in the end.

We can also see this on the daily close only chart for the spot futures spread. The spread moved from a backwardation (inverse) of 79 cents on March 31 to an inverse of $1.63 on June 8. The released oil was still working its way into the system and driving demand was still showing seasonal summer strength. The next week (June 16), though, the Fed came out with its first of four 75-basis point rate increases during 2022. Since then, the spot-spread has been on a slide to a 37-cent contango (carry) as of this Friday.

To make a long explanation longer: The bottom line is both sides of the crude oil market, commercial and noncommercial, have been selling for nearly a year. It isn’t just a nonfarm Friday phenomenon. The key now is to see if the December low of $70.08 holds the latest selloff. We’ll find out over the coming weeks if the markets long-term downtrend is coming to an end or ready for another extension.

If so, all those people going to work will do so using cheaper gasoline. Or brand new electric cars.

More Energy News from Barchart

- Crude Slumps on Dollar Strength and Suspect Chinese Energy Demand

- Nat-Gas Falls as Heating Demand Wanes and Inventories Climb

- Dollar Strength and Suspect Chinese Energy Demand Weighs on Crude Prices

- Crude Prices Slip on Dollar Strength and Robust U.S. Crude Inventories

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.