Who's Foolin' Who

Good Day,

After last Friday’s trade no one could have blamed you for being a little bullish the grain markets. A friendly crop report mixed with some potential weather concerns short term and long term. Funds tripping over themselves to get out of their heavy short position. To back it up Monday’s trade saw Dec corn bump up to $4.95/bu (where there were a lot of sell offers resting) and July KC wheat was up $.30 at one point punching through $7/bu with July Chicago similar getting to a high of $6.94. Then it was over… for now.

The Bad

Wheat prices rallied into lofty territory recently on the backs of Russian weather concerns but there was a base to the rally that started below $6 built on the concerns of domestic weather in HRW country. The USDA wheat tour was this week, and their survey results pegged the crop at a 46.5 bpa for the stops made in mostly Kansas and neighboring Nebraska and Oklahoma. If those results are confirmed when the combines roll into Kansas it’s hard to believe the prices at that time will match the recent highs. Stranger things have happened though and nobody with a wheat position on either side probably feels really comfortable at the moment.

The Ugly

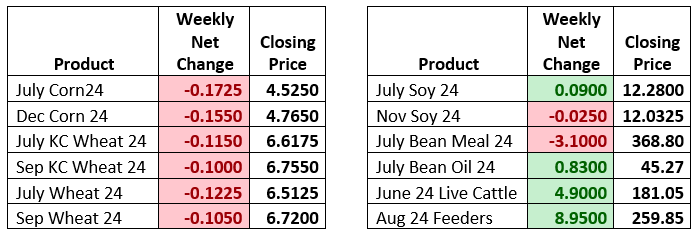

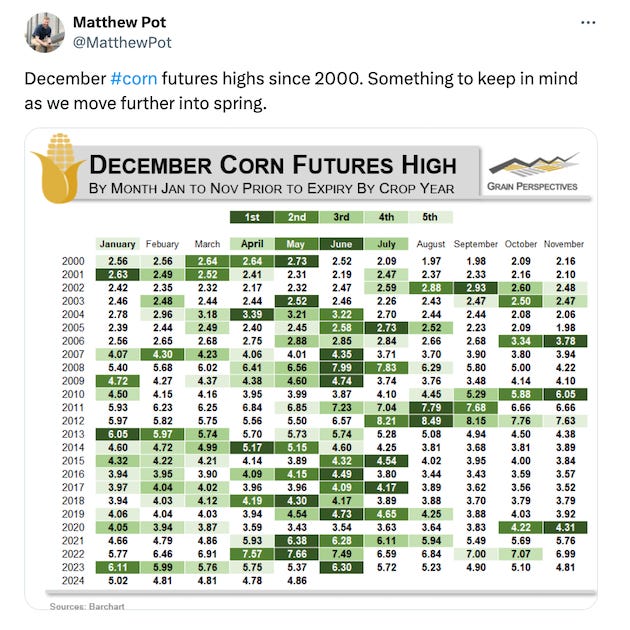

Corn prices did step back this week and while it doesn’t look pretty on a chart it shouldn’t come as a huge shock. May, June, and July are the volatile months and volatility doesn’t mean prices only go up. The weather in July matters most and even though Dec 24 Corn futures closed at $4.765/bu this week, there are more supportive bullish fundamentals then there were at the beginning of the month the last time prices were here.

2024-25 Ending stocks projected at 2.1 billion bu from last week’s WASDE report is ample but not burdensome. If those ending stock projections were to hold, there is room to maneuver on both sides of $4.50/bu post-harvest using this year’s price movement as a pattern. It should also give spring/summertime weather rallies an easier go of it should something develop.

Mexico purchased 405,000 tons of corn this week, split between this marketing year and next. China gets a lot of credit as a shrewd purchaser of soybeans, but in my observations Mexico does it better when it comes to buying corn. They generally make most of their purchases between August and January and avoid making big purchases when prices are historically high. Mexico has been buying more than usual the last 8 months as prices have returned to earth and they were likely short on supply, but it is noteworthy to see them stretching their flash sale purchases into the month of May on a rally.

Before I lose my bearish street cred I should point out that history has shown us rallies in May June and July are still meant to be sold.

Hopefully we see a few more rallies in the weeks ahead.

The (dare I say) Good

Monthly Consumer Price Index (CPI) numbers were released Wednesday. April CPI rose 0.3% below estimates of 0.4% with annual CPI at 3.4% down from 3.5% last month. Core CPI (all items less food and energy) rose the same 0.3% last month bringing the annual Core CPI to 3.6% down from 3.8% last month.

Tracking Inflation and Interest Rates is a turtle race most of the time that is best to let run for months on end before worrying about the leaderboard. Since May of last year annual CPI has ranged from 3% to 4%. The good news is seeing stability after the volatile movement from 2020 to 2023. The bad news is that 3-4% is not the agreed upon goal of 2% or lower that history and the FED have set.

The current FED interest rate sits at 5.25%-5.5% and has been there since last July. The stock market and the economy appear healthy enough for now. There are concerns, of which I have a few, but there are always concerns and if there weren’t you should be even more concerned. Taking a basic survey of the situation it appears that the FED’s plan of action is simple. Until 2% or close to annual inflation is achieved interest rates should stay put. If annual inflation climbs above 4%, raising rates will have to be considered. A second round of inflation will not be acceptable.

“Simplicity is the ultimate sophistication” – Leonardo da Vinci

On the date of publication, Derrick Hermesch did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.