TSX Information Tech Capped Index(TTTK)INDEX/TSX

Estée Lauder (NYSE:EL) Posts Q1 Sales In Line With Estimates But Stock Drops

Beauty products company Estée Lauder (NYSE:EL) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 5% year on year to $3.94 billion. It made a non-GAAP profit of $0.97 per share, improving from its profit of $0.47 per share in the same quarter last year.

Is now the time to buy Estée Lauder? Find out by accessing our full research report, it's free.

Estée Lauder (EL) Q1 CY2024 Highlights:

- Revenue: $3.94 billion vs analyst estimates of $3.91 billion (small beat)

- EPS (non-GAAP): $0.97 vs analyst estimates of $0.50 (95.7% beat)

- EPS (non-GAAP) Guidance for Q2 CY2024 is $0.24 at the midpoint, well below analyst estimates of $0.75 (revenue guidance for the period also missed)

- EPS (non-GAAP) Guidance for full 2024 is $2.19 at the midpoint, below analyst estimates of $2.25

- Gross Margin (GAAP): 71.9%, up from 69.1% in the same quarter last year

- Free Cash Flow of $359 million, down 67.7% from the previous quarter

- Organic Revenue was up 5.9% year on year

- Market Capitalization: $52.59 billion

Fabrizio Freda, President and Chief Executive Officer said, “For the third quarter of fiscal 2024, we delivered our organic sales outlook, exceeded expectations for profitability and continued to improve working capital. La Mer, Estée Lauder, Jo Malone London, Le Labo, and The Ordinary led organic sales growth, driven by beloved hero products and highly sought innovation. Asia travel retail returned to organic sales growth, as developed and emerging markets across Asia/Pacific, EMEA, and Latin America further contributed.

Named after its founder, who was an entrepreneurial woman from New York with a passion for skincare, Estée Lauder (NYSE:EL) is a one-stop beauty shop with products in skincare, fragrance, makeup, sun protection, and men’s grooming.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

Estée Lauder is one of the larger consumer staples companies and benefits from a well-known brand, giving it customer mindshare and influence over purchasing decisions.

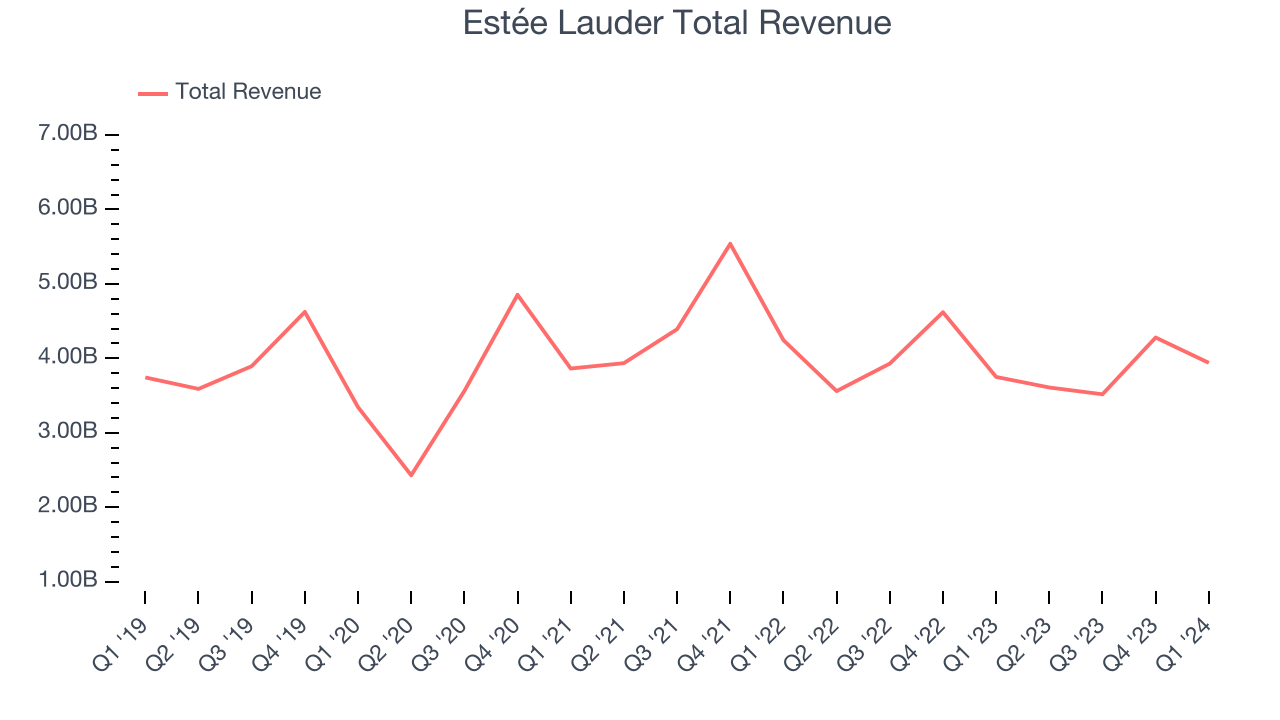

As you can see below, the company's annualized revenue growth rate of 1.4% over the last three years was weak for a consumer staples business.

This quarter, Estée Lauder grew its revenue by 5% year on year, and its $3.94 billion in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 9.6% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Organic Revenue Growth

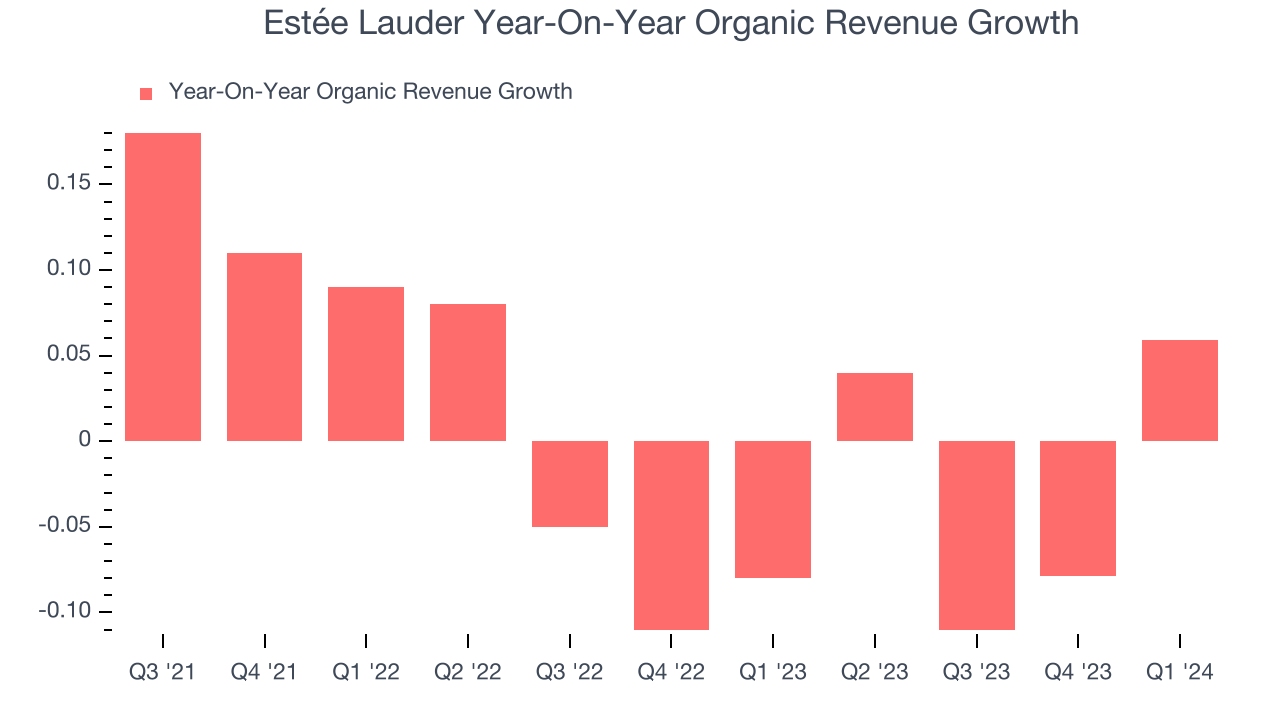

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

Estée Lauder's demand has been falling over the last eight quarters, and on average, its organic sales have declined by 3.1% year on year.

In the latest quarter, Estée Lauder's organic sales rose 5.9% year on year. This growth was a well-appreciated turnaround from the 8% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Key Takeaways from Estée Lauder's Q1 Results

We liked how Estée Lauder beat analysts' EPS expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. On the other hand, its revenue and earnings forecast for next quarter missed analysts' expectations. Full-year earnings guidance also missed Wall Street's estimates. Overall, this quarter's results were fine, but guidance is dragging the stock down. Specifically, the stock is down 5.6% after reporting, trading at $138.5 per share.

So should you invest in Estée Lauder right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.