Whither Alberta?

As The Globe and Mail’s Justin Giovannetti and Kelly Cryderman report today, Alberta is facing its longest slump since the dark days of the 1980s.

“There is no minimizing the impact that low oil prices are having on people’s jobs, on the economy and the government’s fiscal situation,” Finance Minister Joe Ceci said yesterday as he unveiled the province’s fiscal update.

“This is a once-in-a-generation challenge.”

Here are several charts that illustrate the depths of the trouble in the province that is home to Canada’s energy industry.

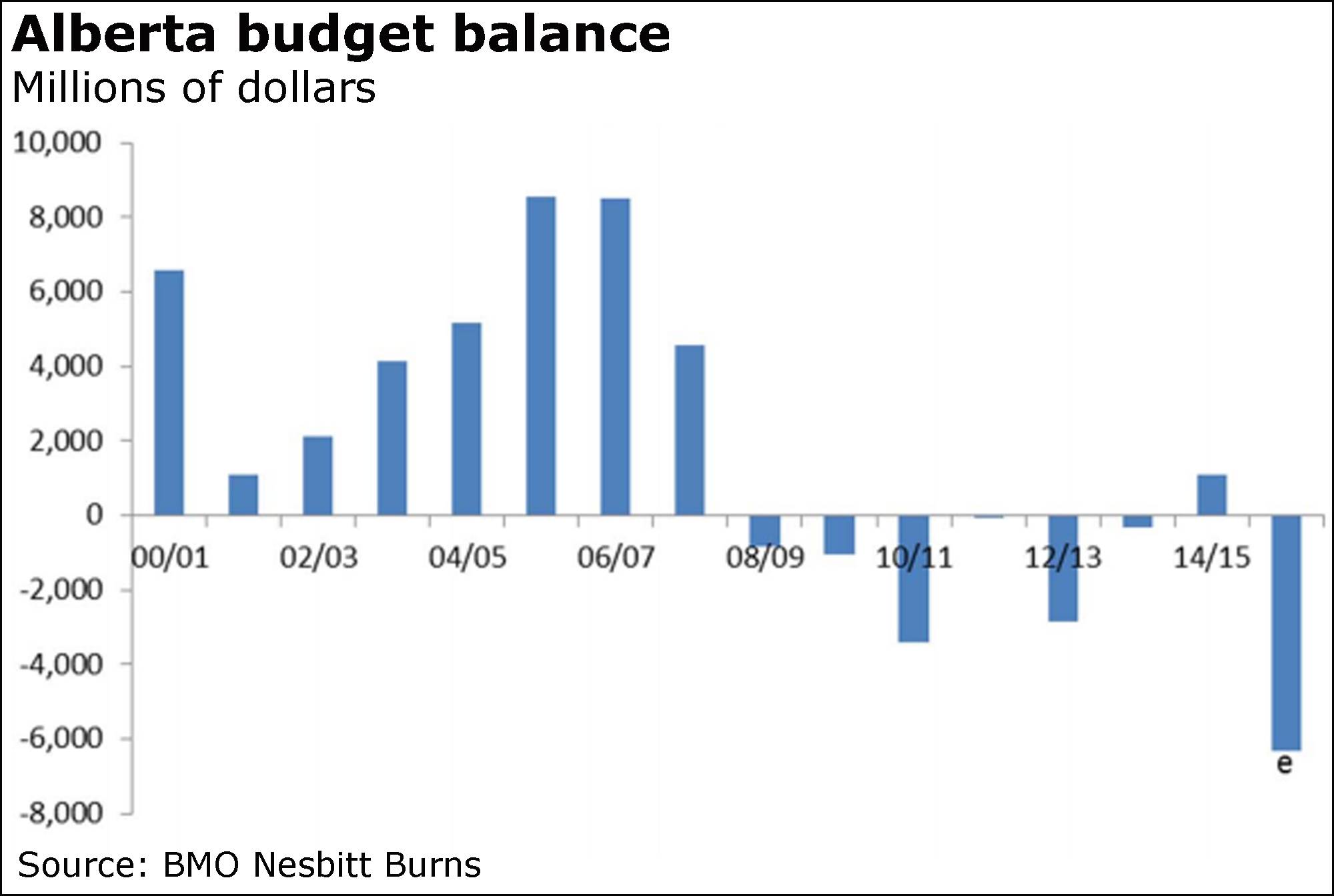

The government books are in awful shape amid the dramatic slump in oil prices.

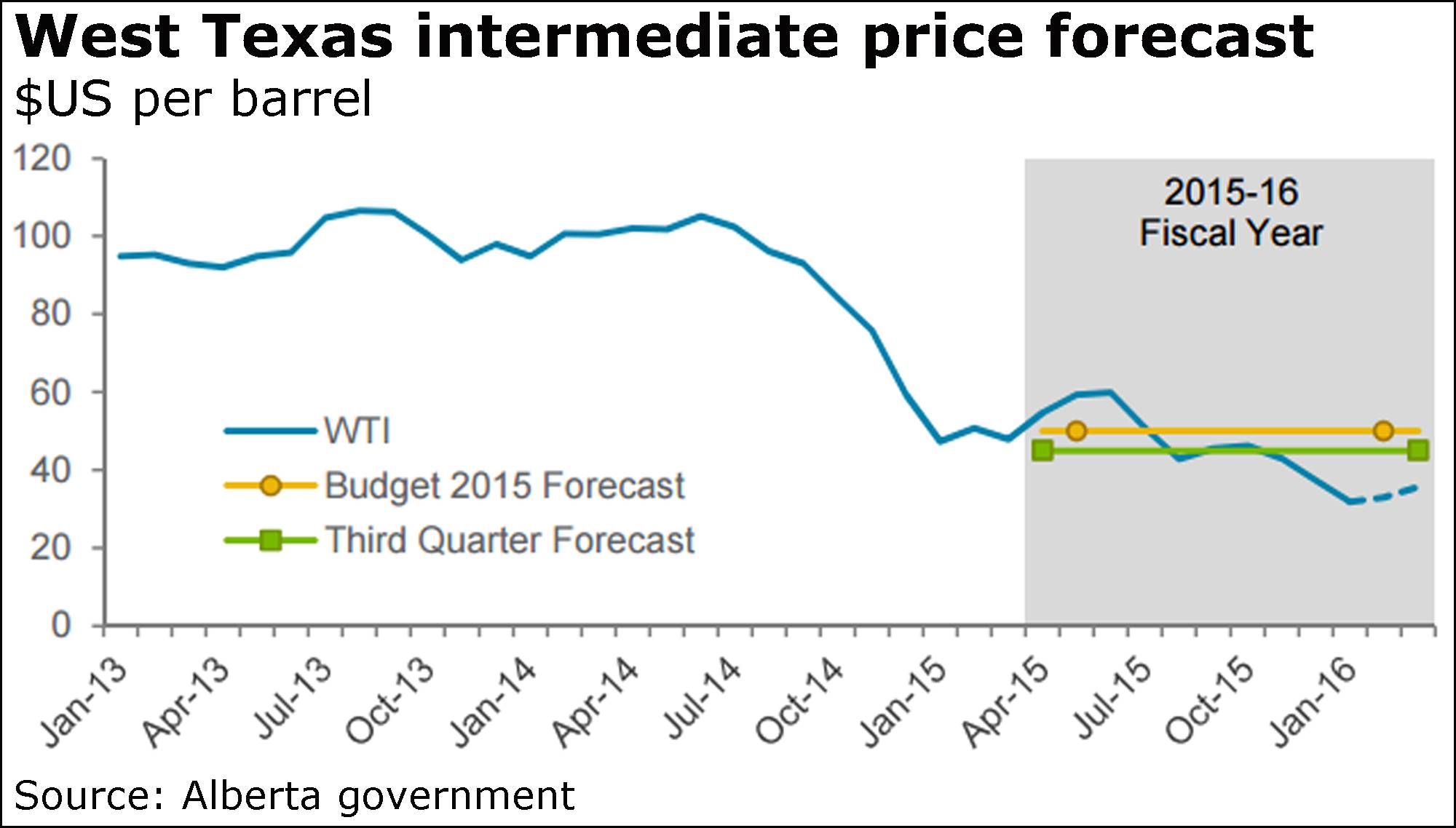

“This is the steepest and most prolonged slide in oil prices in recent history,” Mr. Ceci said. “Projections for a quick recovery have proven wrong.”

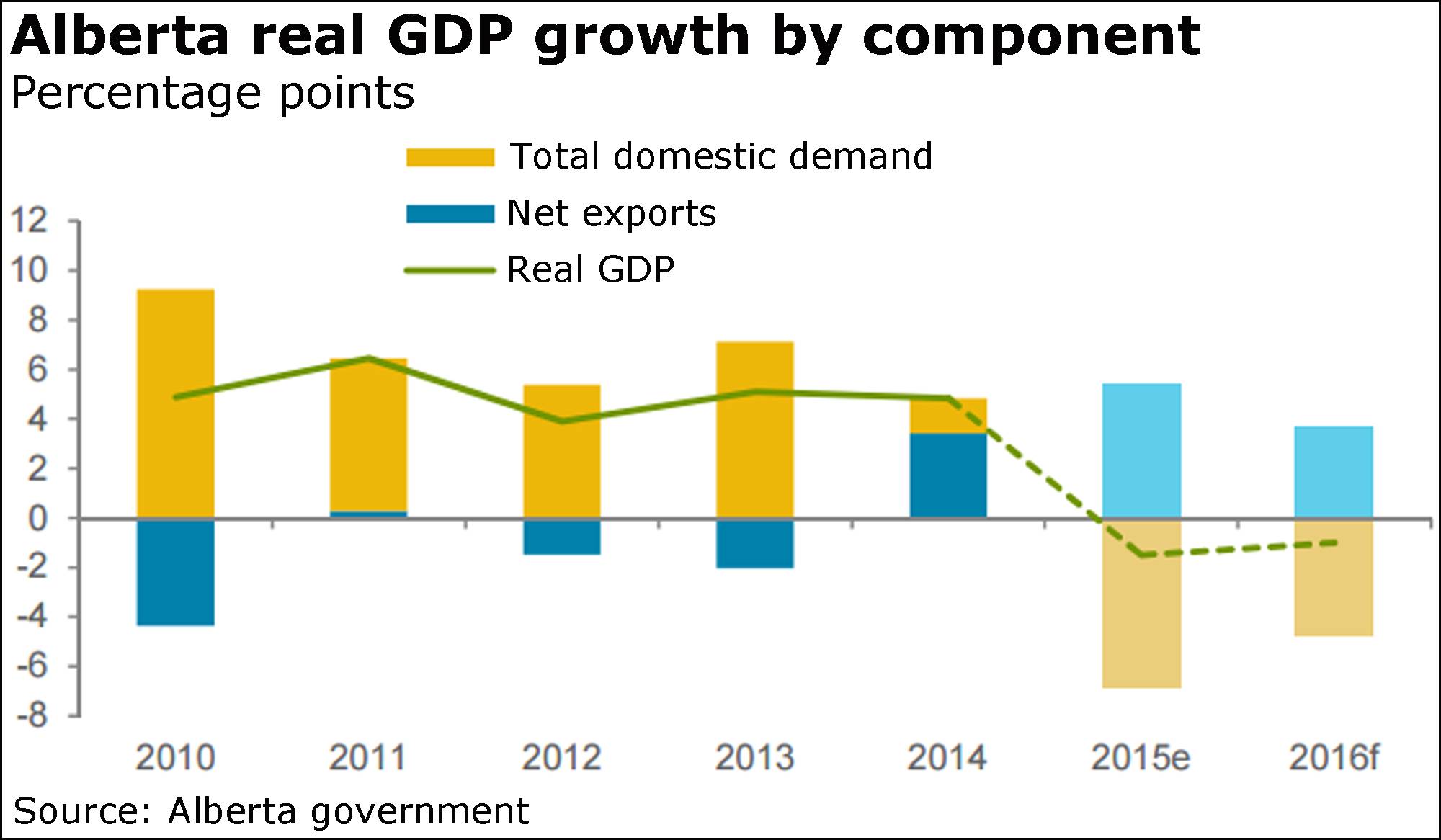

Alberta is in its second year of recession.

Notably, the government said yesterday, investment in the oil and gas sector is forecast to plunge by more than 20 per cent this year.

“Conventional oil and gas investment has slowed considerably, with the number of rigs drilling falling to multidecade lows,” it said in the fiscal update.

“Spending in the oil sands will be limited to maintenance of existing facilities and the completion of projects that were under construction prior to the price decline.”

The government has cut its forecasts for oil prices amid the supply glut.

“Demand growth has been outpaced by rising production from OPEC and non-OPEC sources, and global inventories of crude oil have swelled.”

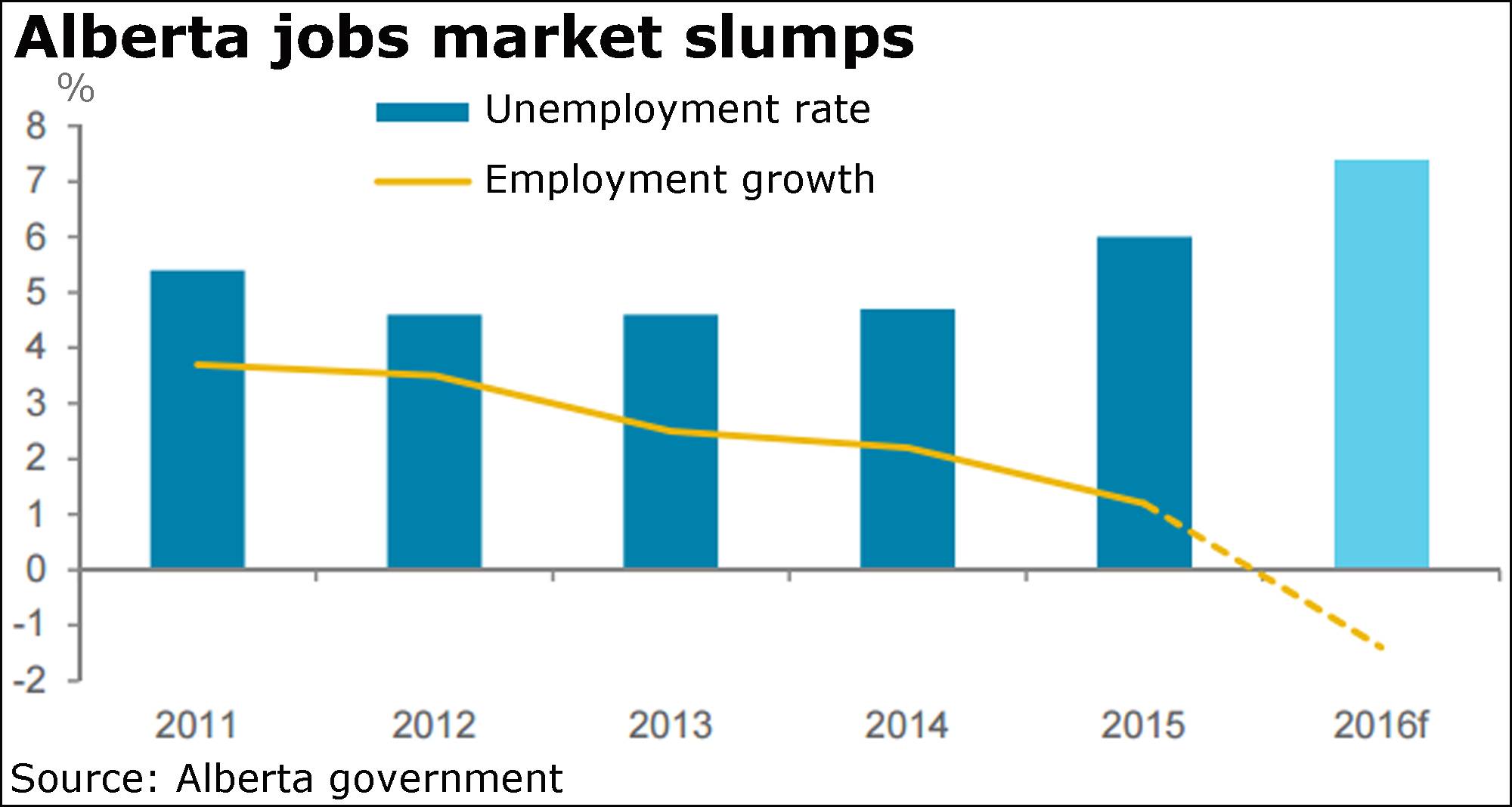

According to the latest reading by Statistics Canada today, Alberta lost more than 66,000 jobs last year as employment declined by 3.2 per cent.

“Combined with declines in employment and weaker investment income, primary household income is expected to decline by 1 per cent in 2016,” the government said.

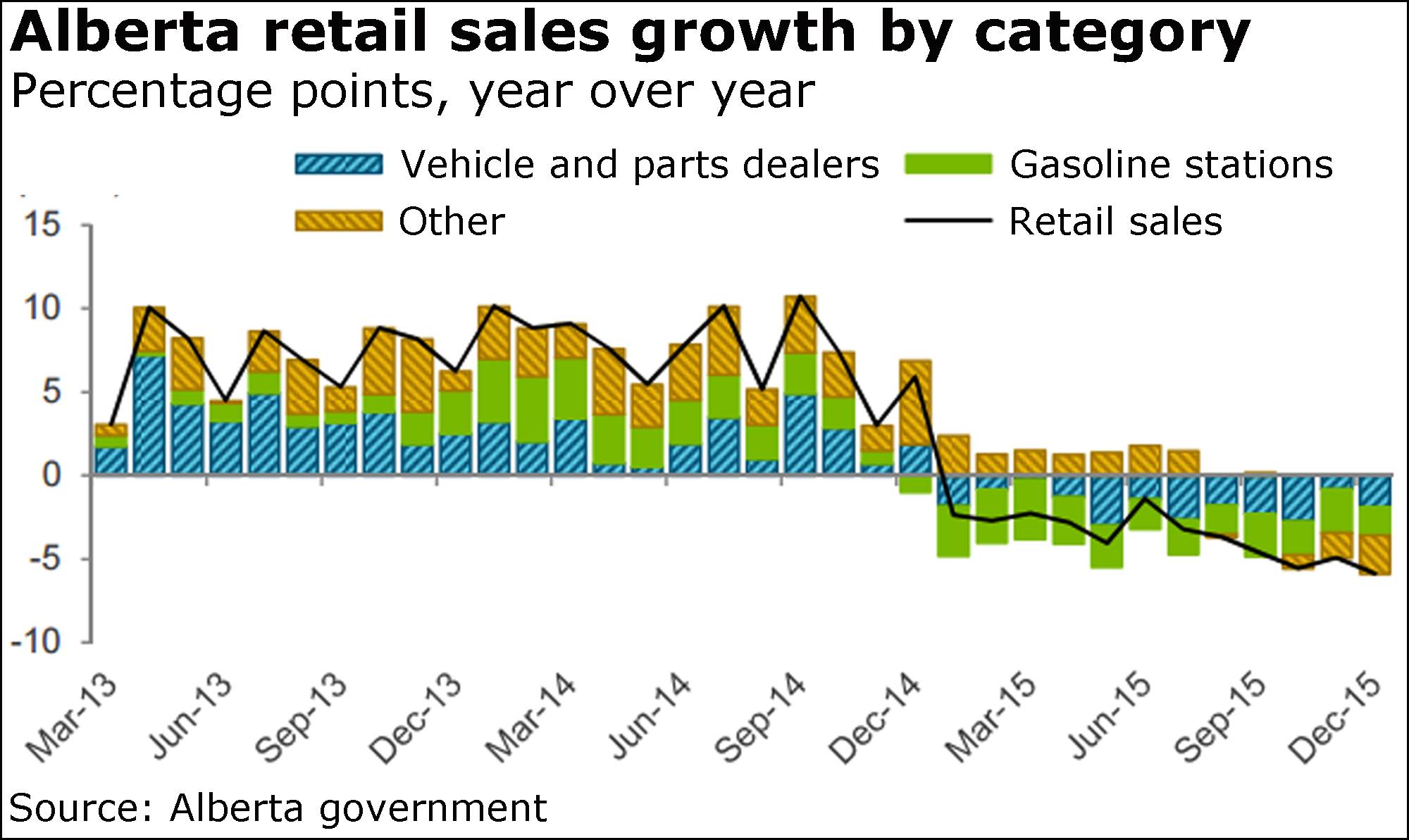

All of which, of course, is going to hit consumer spending.

“With labour conditions expected to weaken further in 2016, household consumption is forecast to fall 0.5 per cent,” the Alberta document said.

Indeed, in a separate report today, DesRosiers Automotive Consultants noted a drop of 10.5 per cent in light vehicle sales in Alberta last month.

Alberta’s housing market is under attack, with a dramatic drop in sales last year.

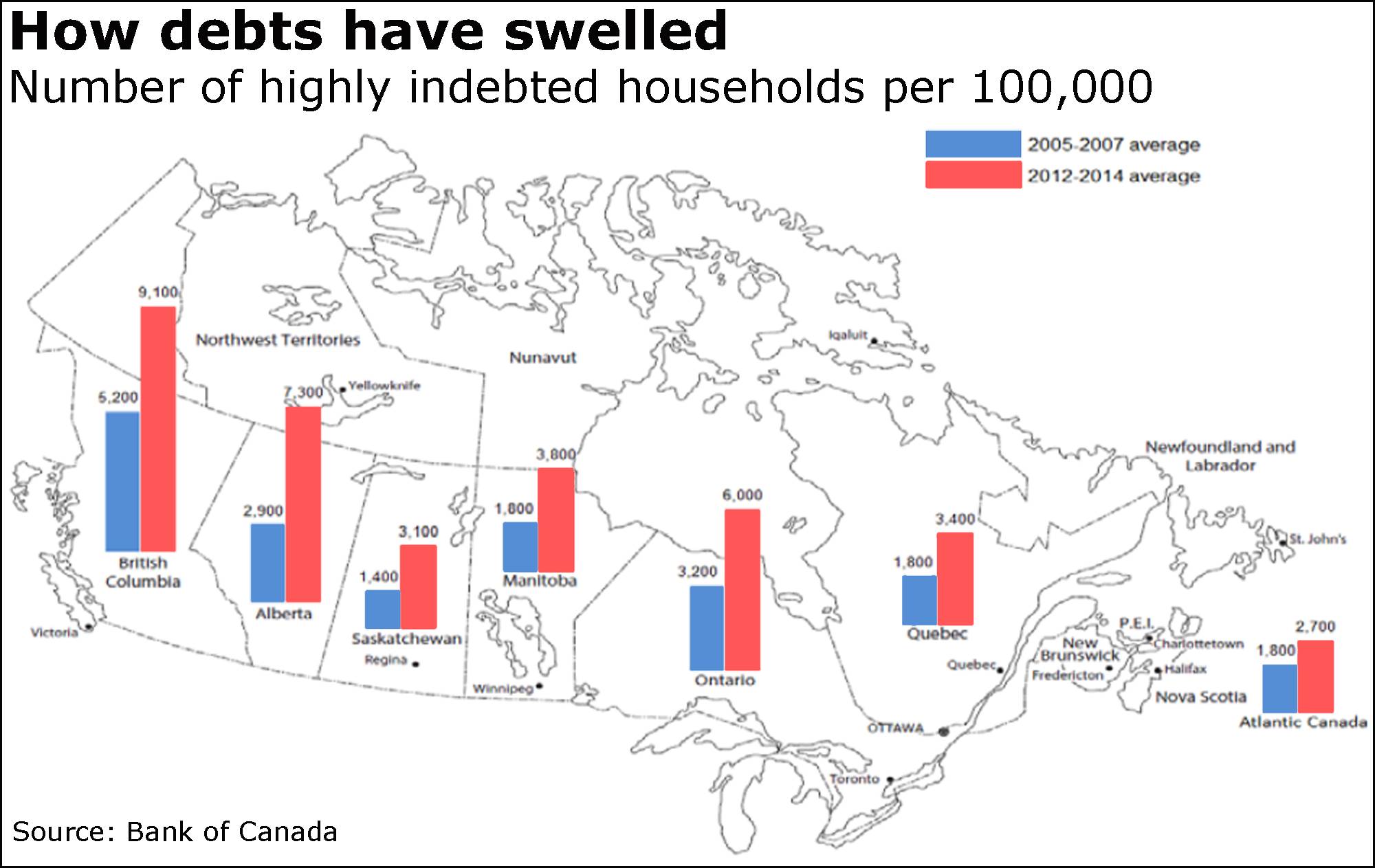

Which doesn’t bode well for high-debt families amid the spike in unemployment.

According to the Bank of Canada yesterday, highly indebted borrowers, or those whose key debt-to-income ratio is at or above 350 per cent, are “disproportionately more likely to live in British Columbia, Alberta or Ontario, provinces where house prices are the highest.”

A scene I'd love to see ...

“You get the chips.”

CIBC, TD boost dividend

Two of Canada’s big banks raised their dividends today amid higher first-quarter profit.

Canadian Imperial Bank of Commerce boosted its payout by 3 cents to $1.18, and Toronto-Dominion Bank by 4 pennies to 55 cents.

CIBC’s profit rose to $982-million, or $2.43 a share, compared with $923-million or $2.28 a year earlier.

TD ‘s profit climbed to $2.2-billion, or $1.17 a year, from $2.1-billion or $1.09.

Like other Canadian executives, TD chief executive officer Bharat Masrani cited the “challenging environment” of late.

IMF on Canada

Compared to other economic forecasters, the International Monetary Fund is positively upbeat where Canada is concerned.

In its latest outlook, the IMF projects Canada’s economy will expand by 1.7 per cent this year, which would be far from buoyant but nonetheless a better showing than that expected by the Organization for Economic Co-operation and Development and the Canadian government, whose forecasts are based on those of private-sector economists.

Both the OECD and the federal government project economic growth of just 1.4 per cent, which, in turn, is much better some other forecasts that indicate expansion of 1 per cent or less.

Based on the IMF’s report, Canada will perform better than some Group of Seven countries, notably France, Italy and Japan.

The group didn’t change its outlook for Canada this year, which is surprising given the economic hit from the oil rout and the fact that other forecasters have been slashing their projections.

For 2017, though, it trimmed its forecast to growth of 2.1 per cent, down from an earlier projection of 2.4 per cent.

The forecasts are part of a report to G20 finance ministers and central bankers who are heading to a two-day meeting in Shanghai.

The IMF report calls for “bold multilateral actions” to juice the global economy.

“To support global activity and contain risks, the G20 must act now to implement forcefully the existing G20 strategies and plan for co-ordinated demand support using available fiscal space to boost public investment and complement structural reforms,” it said.