Good evening,

WHAT YOU NEED TO KNOW

Trudeau pledges access to medication as pharmacists, patient groups fear shortage

Prime Minister Justin Trudeau is pledging to ensure Canadians have access to medication they need at affordable prices in the face of concerns about a U.S. decision to allow prescription drug imports from Canada.

On Wednesday, the Trump administration revealed a proposal aimed at allowing American patients to import cheaper medications from outside the country, under the oversight of the Food and Drug Administration. Canada was not consulted on the specifics of the plan ahead of time, officials confirmed Wednesday.

Several groups, including the Canadian Pharmacists Association, issued warnings that the Canadian supply cannot support both Canadian and U.S. consumers.

Conservative Party health critic Marilyn Gladu says concerns about drug shortages for Canadians must be taken seriously, adding that swift action must be taken if the drug supply worries become reality.

This is the daily Evening Update newsletter. If you’re reading this on the web, or it was forwarded to you from someone else, you can sign up for Evening Update and more than 20 more Globe newsletters on our newsletter signup page.

SNC-Lavalin slashes dividend as it reports $2.1-billion quarterly loss

SNC-Lavalin is cutting its quarterly dividend for the second time this year to $0.02 per share from $0.10 as it moves to pay down debt and strengthen its balance sheet, the Montreal-based company said in its second- quarter earnings release Thursday. The company swung to a $2.1-billion loss for its latest quarter. It has also mandated a new manager reporting directly to its chief executive officer to oversee the closing out of 11 big lump-sum turnkey contracts over the next several years.

Interim CEO Ian Edwards is trying to chart a new course for the company that will see it take on less-riskier work amid unprecedented legal challenges that have put SNC employees and investors on edge. The company has lost about half its market capitalization since January and its stock is plumbing lows last seen 14 years ago.

SNC-Lavalin reported a net loss of $2.1-billion or $12.07 per share for the second quarter on revenue of about $2.3-billion. That compares to a profit of $83-million or $0.47 per share for the same quarter last year. The shares have dropped in seven of the last nine trading sessions since July 22, when the company took the market by surprise in saying 2019 financial results would come in “significantly lower” than anticipated and withdrew its previous annual earnings forecast. Management has blamed higher costs on infrastructure and resource projects.

Oil sands CEOs urge voters to support energy industry in October federal election

Top executives of three Calgary-based oil sands companies published an “open letter" Thursday that urges Canadians to support the much-criticized sector when they go to the polls in the national election due this October, an ad blitz that is part of a wider oil industry campaign to elect a sympathetic government.

Presidents at Cenovus Energy Inc., MEG Energy Corp. and Canadian Natural Resources Ltd. took out ads in 30 newspapers across the country on Thursday, touting their industry’s record and encouraging Canadians to push all political leaders to “help our country thrive by supporting an innovative energy industry.” The letter did not explicitly support any of the federal parties.

The Canadian Association of Petroleum Producers (CAPP) pursued a similar campaign in last spring’s Alberta election with a message it claimed to be non-partisan but was widely seen as favouring the United Conservative Party and its Leader and now Premier Jason Kenney. CAPP has vowed to launch a similar initiative for the federal election while, separately, some of its board members from non-oil sands companies were part of an April strategy session that included Conservative Party Leader Andrew Scheer and some top party organizers.

London Stock Exchange agrees to buy Refinitiv in ‘defining’ deal

London Stock Exchange has agreed to buy financial information provider Refinitiv in a US$14.5-billion deal aimed at offering trading across regions and currencies and establishing the British company as a rival to Bloomberg. The deal also includes the assumption of US$12.5-billion in Refinitiv debt.

The deal, which was confirmed on Thursday and is subject to regulatory and shareholder approval, will expand LSE’s trading business beyond shares and derivatives into currencies and make it a major distributor as well as creator of market data.

The deal comes amid uncertainty over Britain’s exit from the European Union. LSE shares could fall if Britain leaves without a deal.

WHAT ELSE IS ON OUR RADAR

Bombardier reports quarterly loss weighed down by rail department

Challenges in Bombardier Inc.’s rail department weighed on earnings on Thursday as the company reported a quarterly loss and aimed to sway concerns with prominent rail contract delays. It posted a net loss of US$36-million, or 4 cents per share, in the second quarter ended June 30, compared with a profit of US$70-million, or 2 cents per share, a year earlier.

The Canadian plane and train maker posted second-quarter results that fell below analysts’ expectations as it struggles with several rail contracts that have delayed payments and affected cash flow. To maintain delivery schedules, the company also announced that it is pumping additional investment into Bombardier Transportation as part of its plan to revive the business.

Ottawa creates new marine protected area in northern Canada

Prime Minister Justin Trudeau announced the creation of a new marine protected area near Arctic Bay – an Inuit hamlet on the northwest corner of Baffin Island – known as the Tallurutiup Imanga National Marine Conservation Area, and a second area on the northwest coast of Ellesmere Island that will be known as the Tuvaijuittuq Marine Protected Area.

Federal government to launch ‘patent collective’ giving Canadian innovators better IP protection

Ottawa has chosen a new non-profit entity called Innovation Asset Collective (IAC) to run a four-year pilot project known as a “patent collective,” Innovation Minister Navdeep Bains announced Thursday. The project, financed with $30-million in federal money, will help small and medium enterprises (SMEs) with their IP needs, in part by buying and holding patents related to data and clean technology that member companies can license on a perpetual basis to protect themselves against IP infringement lawsuits, a common hazard in the sector.

IP has increasingly become a cornerstone of the global economy. IP assets are different than traditional physical assets, whose values are determined in part by infrastructure, supply chains and the movement of goods across borders. By contrast, governments determine IP value by granting exclusive rights to restrict access to the assets, which, particularly for software, are accessible by millions of people around the world simultaneously.

MARKET WATCH

Wall Street drops as trade war woes back in focus

U.S. President Donald Trump sent financial markets reeling on Thursday when he announced an additional 10 per cent tariff on $300-billion in Chinese products would take effect next month.

The Dow Jones Industrial Average fell 280.85 points, or 1.05 per cent, to 26,583.42, the S&P 500 lost 26.82 points, or 0.90 per cent, to 2,953.56 and the Nasdaq Composite dropped 64.30 points, or 0.79 per cent, to 8,111.12.

The Toronto Stock Exchange’s S&P/TSX composite index was down 29.52 points, or 0.18 per cent, at 16,377.04.

Got a news tip that you’d like us to look into? E-mail us at tips@globeandmail.com. Need to share documents securely? Reach out via SecureDrop.

TALKING POINTS

Scott Reid on Doug Ford: “If he truly hoped to help the current crop of federal Conservatives and halt Mr. Trudeau’s re-election, Mr. Ford would make the grand sacrifice of simply not being himself for a few months. Instead of interrupting the summer recess with weekly outbursts of bellicosity and controversy – firing his own government’s appointees and fighting with the parents of autistic children – he would just go silent.”

Konrad Yakabuski on the Oka conflict: “Twenty-nine years ago this month, an attempt by the town of Oka to expand a golf course into a territory known as the Pines, considered sacred by the Mohawks, thrust their then-270-year-old plight into the international spotlight. It is more than high time that the federal government put an end to their waiting, which has lasted not 30 years, but 300.”

Bessma Momani on Saudi sisters seeking refuge: “When Canada stands up for human rights, and vows to protect the most vulnerable, people around the world will notice. Two Saudi sisters, Dua and Dalal al-Showaiki, need Canada to put its money where its mouth is and accept them as refugees.”

Waeza Shamsia Afzal on boycotting Hajj: “Every year, at around the time of the Hajj – which begins on August 9 this year – instead of feeling reverent, I find myself feeling disturbed. I have reflected on the ethics of performing the pilgrimage, and believe that until an independent body governs Mecca instead of the government of Saudi Arabia, people should boycott the pilgrimage.”

Rob Carrick on Money Diaries: “In its U.S. version, Money Diaries has generated discussions so intense that a publicist seeking media attention for the Canadian launch called it ‘everyone’s favourite voyeuristic hate-read.’ Expect the same or worse in Canada, where anxiety about money has produced epic levels of judgy thoughts about how others spend – or don’t spend.”

LIVING BETTER

Focus, consistency and patience.

Those are three lessons blogger James Clear gathers from the Game of Thrones phenomenon. And if those don’t come to you from watching the saga, that’s because he is drawing it not from the television series or even the books, but by the working life of the creator, George R.R. Martin.

Mr. Martin was a failure before he was a success. He wrote early books that flopped. But he has kept at his craft, doggedly and consistently. Sure, he probably would have loved to be a success earlier in his career. But he waited for his time. “The greatest display of patience is a continued commitment to the process when you’re not being rewarded for it yet,” adds Mr. Clear.

So focus, consistency and patience – the key to the throne.

LONG READ FOR A LONG COMMUTE

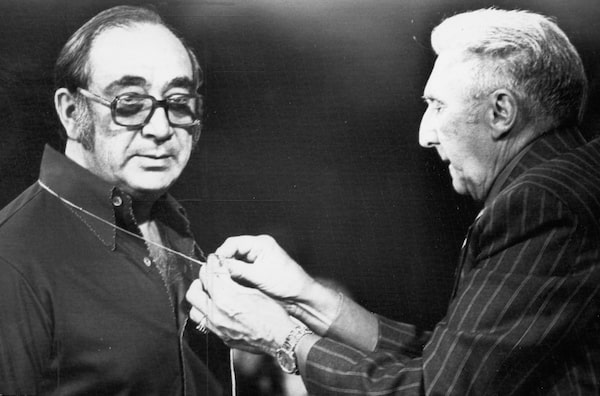

A clerk of the court places a microphone around the neck of former Montreal meat magnate William Obront in 1976. Mr. Obront was sentenced to one year in jail for his refusal to talk.The Canadian Press

Montreal butcher was a banker for the Mafia

William Obront, a Montreal meat merchant who once made front-page headlines across Canada after a public inquiry named him as a key money launderer for the Cotroni Mafia clan, has died.

He had been mixed up in three major scandals in the 1960s and 1970s, but vanished from the spotlight after getting a lengthy sentence for drug trafficking in Florida.

His death in Miami-Dade County – on Oct. 12, 2017, at the age of 93 – was not reported at the time, but The Globe and Mail confirmed it through Florida state records.

He was a behind-the-scenes figure in the Gerda Munsinger case, a Cold War scandal featuring sex, politicians and the spectre of Soviet spying.

Evening Update is written by Dianne Nice. If you’d like to receive this newsletter by e-mail every weekday evening, go here to sign up. If you have any feedback, send us a note.